Ten Problems with Trust Deed Investments

If you’re in the research phase of trust deed investing, you are probably looking online, talking to mortgage brokers and to friends who have...

Like most of First Capital Trust Deed’s current trust deed investors, you have funded private money loans in the past and are familiar with how the process works. Maybe you’ve worked with other private money mortgage brokers over the years and FCTD is new for you.

This blog post will cover the upfront preparation work required of you prior to funding your first loan, and outline the steps in the process to ensure that you get started trust deed investing with FCTD on the right foot.

Prior to reviewing funding opportunities, it’s good to start with the people and companies you’ll be working with in this process.

FCTD is a brokerage specializing in mortgages for real estate investors, licensed in five states (CA DRE & CFL, OR, WA, ID, and FL). The company was founded by Brett Everett and Ted Spradlin in 2013. As of this writing in July 2022, FCTD has originated over $2 billion in private money, NonQM, and bank loans, which includes $355 million in loans with individual trust deed investors. The company is continually investing in software automation to meet the needs of our borrower and lender clients along with all the third parties involved in the transactions.

The majority of FCTD’s trust deed investor funded loans have been in California. The Department of Real Estate in California has a handbook that we recommend prospective investors read prior to getting into trust deed investing:

FCI in Anaheim Hills handles most of the loan servicing for our trust deed investors. FCI’s trustee company, California TD Specialists, is the most common trustee on investor funded loans. The pricing starts at a $55 setup fee on a new loan and a minimum of $15/mo servicing fee on loans up to $400,000, increasing by $10/mo with each $100,000 increment on the loan balance. FCTD has automated the servicing setup process for our investors and borrowers using FCI’s forms.

FCTD works with individual investors who have one or several different entities they fund loans through. These include:

We ask for the vesting to be confirmed early in the process because private money loans can close within a few days. FCTD sends lender (and borrower) vesting and documentation to Title for accuracy.

Let’s have a short call to discuss your previous history funding trust deeds, what you like and don’t like, and what you want going forward.

We have an Investor Intake that covers all aspects of your investing preferences, including:

The California Department of Real Estate requires borrowers to complete either an annual RE 870 Investor Questionnaire (and kept on file) or an Investor Suitability disclosure with each loan.

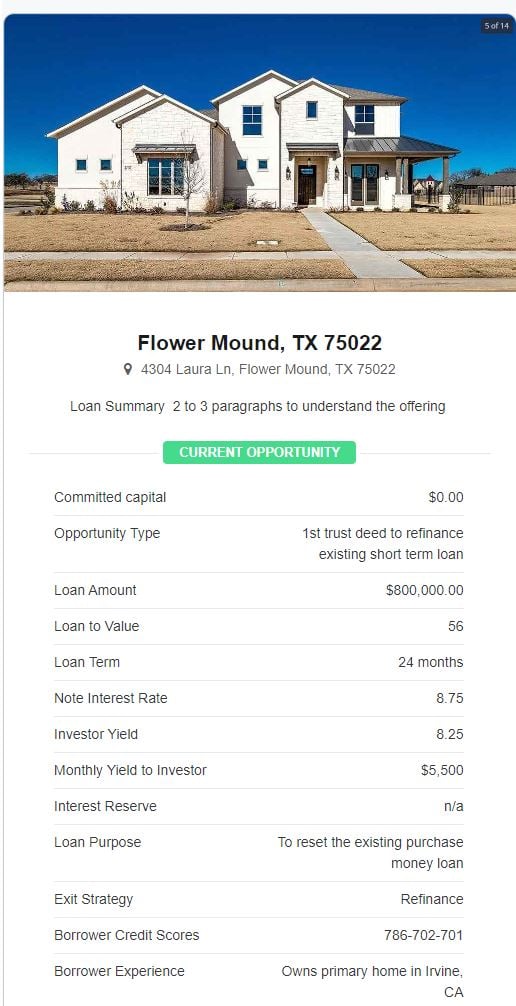

After we have a good understanding of your loan preferences, it’s now time to start receiving trust deed investment opportunities, which will come in a summary similar to this:

In addition to the summary, FCTD can provide the following information:

Once you commit to funding all or part of the loan, you’ll have time to do your due diligence on the property prior to the drafting of loan docs and funding.

For investors who prefer loans within driving distance from where they live, this gives them an opportunity to drive the property.

If it’s listed for sale, some of FCTD’s lenders are licensed real estate agents who will contact the listing and/or selling agents, requesting a time for a 5-10 minute walkthrough of the property. Some lenders will meet the agent at the property or just use their Supra key to check the property, as is the case with vacant properties.

One of our lenders who runs a family office makes it a requirement to meet the borrower at the property. Usually, these site visits are uneventful and are exactly what the borrower has represented to FCTD and the lender. However, there was one site visit around 2015 where the lender called to back out of the loan after meeting the borrower, whose story changed from the property being a flip (business-purpose loan) to wanting to move in (consumer loan) and sell their existing home. This family office only funds business-purpose loans.

This is where Aida Ojeda, FCTD’s Funding Manager, does a lot of the work behind the scenes.

Here’s what happens to get the loan closed:

The loan has closed but there is still work to do.

If you’re interested in working together, here are the next steps to get started trust deed investing:

Please feel free to reach out with any questions about trust deed investing.

If you’re in the research phase of trust deed investing, you are probably looking online, talking to mortgage brokers and to friends who have...

If you’re an investor and want to get a good idea of the types of loans that FCTD originates with private beneficiaries like yourself, this Best of...

There are many pros and cons of trust deed investing. It could be the right move for you, especially if you want to seek out alternative investment...