Do You Fund Hard Money Second Mortgages to Cure a Foreclosure on Owner-Occupied First Mortgages?

If you're seeking a hard money second mortgage to cure the foreclosure action on the owner-occupied first mortgage secured by your primary residence,...

4 min read

Ted Spradlin

:

Sep 25, 2024 12:00:00 PM

Ted Spradlin

:

Sep 25, 2024 12:00:00 PM

An owner-occupied private money consumer purpose bridge loan is a short-term financing option for homeowners to purchase a new primary residence before selling their current home. Owner-occupied bridge loans offer homeowners the benefit of “buy now, sell later,” enabling them to make a strong, non-contingent offer on their next property, while waiting to get top dollar on their existing home. The consumer purpose bridge loan also positions homeowners to qualify for the most favorable long-term financing options after their departing home sells.

This article will cover the basics of owner-occupied private money consumer purpose bridge loans, including:

There’s a lot to unpack here, so we’ll break it down by the components.

Owner-occupied is a person’s primary residence, meaning they, as the owner, physically occupy the dwelling. (An example of a non-owner-occupied dwelling would be a rental property.)

Private money loans, also known as hard money loans, are mortgages made by trust deed investors (usually high-net-worth individuals), mortgage funds, family offices, or private mortgage lenders. Private money and hard money loans are primarily used by real estate investors, including house-flippers, home builders, and landlords to buy a vacant property without the cashflow to qualify for long-term bank financing.

A consumer purpose loan is a mortgage secured by a consumer’s primary residence or their second home, intended for personal or household use. This differs from a business purpose loan, which is a mortgage secured by an investment property (rental) or for use in one’s business (home builder, house-flipper, or owner-user of a commercial building).

A bridge loan is a short-term loan – anywhere from 3-24 months – that provides interim financing until the property is either sold or stabilized (fully leased) and can be refinanced into a long-term loan.

An owner-occupied private money consumer purpose bridge loan is a short-term loan that allows a homeowner to buy their next property prior to selling their current home.

It’s said that one single residential real estate transaction impacts six or seven other transactions, like a domino effect. If just one transaction is held up for financing, repairs, or something else, it affects multiple other transactions queued up, ready and waiting to close.

The “buy now, sell later” nature of owner-occupied private money bridge loans allows a homeowner to purchase a new home before their current, or departing home, has sold.

It’s somewhat common for real estate transactions to be slowed by financing delays – especially for self-employed borrowers, who are often required to provide additional documentation from their CPA and other third parties.

If a homeowner is selling their house to a self-employed buyer, the close of escrow might be 15, 20, or even 60 days delayed to satisfy unexpected underwriting conditions. But the seller needs the net proceeds from the sale to cover the down payment on the new purchase in order to close escrow on or before the deadline – because the seller of that property needs to close escrow on their next purchase (and on and on it goes).

These situations are stressful for all parties involved. And after several extensions have passed, sellers may issue a 3-day notice to perform, as a final ultimatum.

But a homeowner who uses a private money consumer purpose bridge loan to buy now, sell later, keeps the gears on all dependent transactions churning along.

.jpg?width=1012&height=341&name=40%20Years%20Falling%20Mortgage%20Rates%20and%20Rising%20Real%20Estate%20Values%20(Motley%20Fool%20%26%20The%20Mortgage%20Reports).jpg)

After 40+ years of falling interest rates and rising real estate values, long-time homeowners have significant equity in their homes, especially in California. Many homeowners have their mortgage paid off entirely or have a low-balance mortgage from the historic 2020-2022 period, when 30-year fixed-rate loans dipped as low as 2.25%.

For those downsizing or moving their equity out of California to places like Bend, Oregon, where I live, a short-term private money consumer bridge loan can be used in two different ways:

If a homeowner’s house is paid off, they can cash-out refinance in first position to fund an all-cash offer on a new home, whether in California or another state. It’s just easier to buy a home as a cash buyer.

Many homeowners will pull out additional funds to cover 3-4 mortgage payments with the private money loan until their home sells.

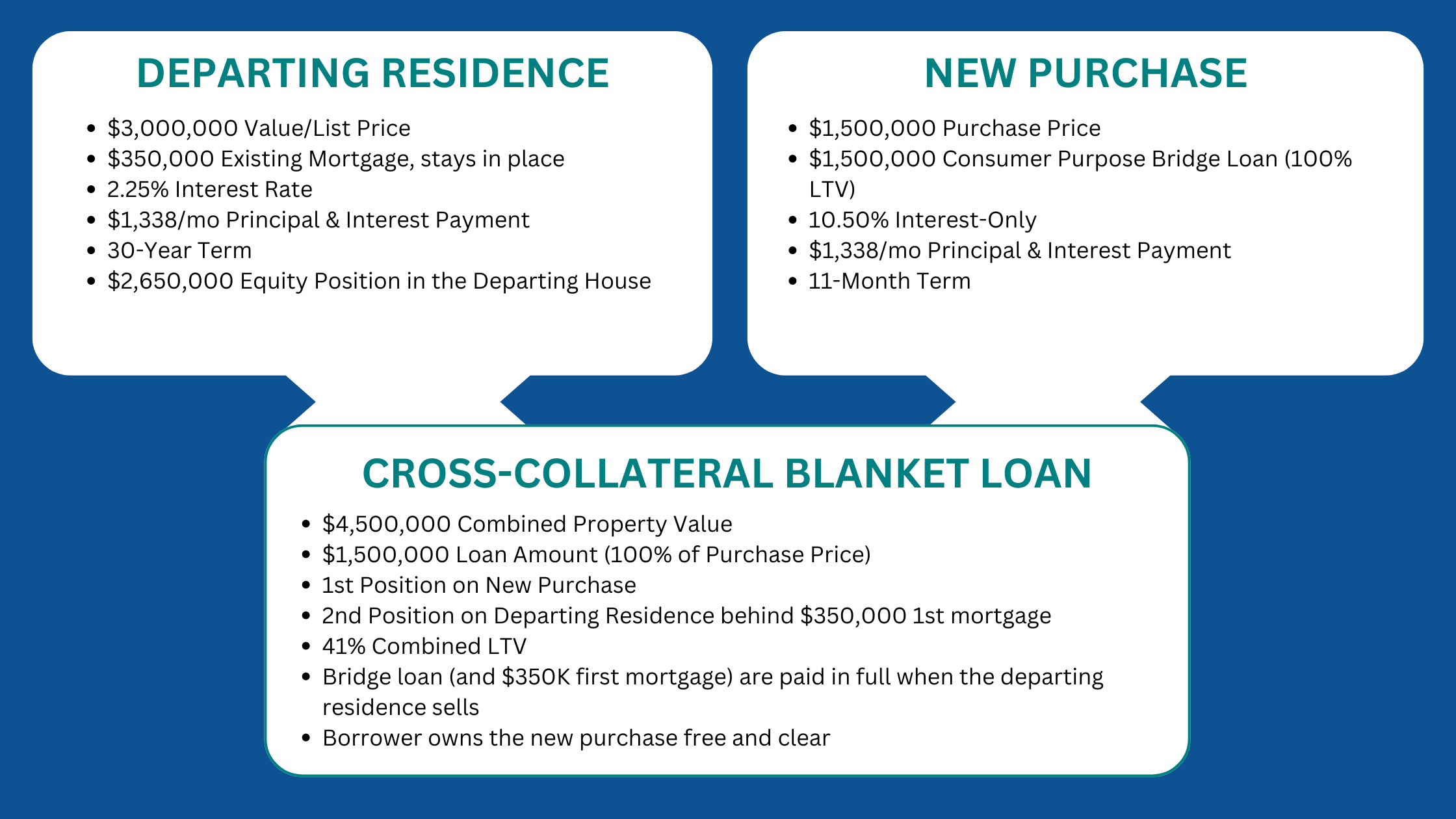

If a homeowner has a mortgage balance on their departing home with an interest rate in the 2’s or 3’s, a private money bridge loan is often structured as one new loan against both the departing home and the new purchase. In private money and hard money lending, we refer to this as a cross-collateral blanket loan.

Usually, a cross-collateral blanket loan will be in first position financing 100% of the new purchase and in second position on the departing residence behind the existing debt. As lenders and mortgage brokers, we don’t want to replace a 2.25% 30-year mortgage with a 10.50% 11-month bridge loan, so we’ll keep the 30-year fixed rate loan in place and use the significant equity of the departing residence to make the loan work.

Whether the departing home is owned outright, or a low-interest mortgage balance remains, there are flexible ways to structure the loan to fit the borrower’s situation and needs.

Summary

Timing the purchase of a new home can be tricky, especially when existing home equity isn’t readily available for a cash offer or expedited closing. Owner-occupied hard money consumer purpose bridge loans can be a lifesaver in these situations, allowing borrowers who either own free and clear or have significant equity in their existing home to “buy now, pay later.” These short-term, higher-interest loans can smooth the closing process on a new home, providing faster funding, while giving the homeowner more time to sell their existing home and repay the bridge loan in full.

If you're seeking a hard money second mortgage to cure the foreclosure action on the owner-occupied first mortgage secured by your primary residence,...

If you’ve been looking for an owner-occupied hard money loan for your primary residence in Washington state, chances are you’re not having any luck...

A homebuyer secured a seller-financed first mortgage at 85% Loan-To-Value (LTV) and asked if FCTD could provide a hard money second mortgage for the...