GUIDE TO BUSINESS PURPOSE HARD MONEY SECOND MORTGAGES

Introduction

In this Guide to Business Purpose Hard Money Second Mortgages, you’ll learn the most important details about business purpose and investment purpose second mortgages.

What is a Business Purpose Hard Money Second Mortgage?

A business purpose hard money second mortgage is simply a private junior lien where the funds or proceeds go toward specific business or real estate investment uses.

Examples of funds used for business and real estate:

Business Use of Funds

Real Estate Investment Use of Funds

As mentioned above, Business Purpose Loans are for specific business or real estate investment uses.

Consumer Purpose Loans are for personal or household use, like a loan on a primary residence or second home.

| BUSINESS PURPOSE (investment property or business use) |

CONSUMER PURPOSE (personal or household use) |

|---|---|

| Owner-occupied business purpose mortgage, available in CA, OR, ID, AZ, MT, and FL (not available in WA state) | Debt consolidation |

| Investment property second mortgage | Home improvement loans |

| Gap funding (fix-and-flip project) to cover down payment, closing costs, and rehab (extremely rare - most are funded by an equity partner) | Divorce settlement |

| Cross-collateral blanket loan - one loan secured by multiple properties | Estate settlement - paying out family members |

| Cash-out second mortgage to buy a vacation rental | Second mortgage behind a reverse mortgage |

| "Cash-out" of residential property to complete "cash-in" refi on commercial property | Bail bond financing |

| Construction completion on an investment property | Income taxes |

| Home equity line of credit (HELOC) - CA properties only | Personal judgments |

| Bankruptcy (Chapter 13) buyout | |

| Foreclosure bailout (primary or second home) | |

| Seller financing (85% LTV) plus hard money second (100% CLTV) for down payment, closing costs, and moving expenses | |

| Second mortgage for down payment and closing costs behind an FHA loan with 96.50% LTV |

Like nearly all hard money lenders, we only facilitate business purpose hard money and private money second mortgages. This is important, because if you’re looking for a consumer purpose hard money second mortgage, you have different options available to you. We discuss this in detail in our Guide to Consumer Purpose Hard Money Second Mortgages.

Is there a Difference Between “Hard Money” and “Private Money” Second Mortgages?

Most people, including myself, will use “hard money” and “private money” interchangeably to describe the same type of short-term, asset-based real estate loan secured by a hard asset – the real property. Thus, the name “hard money” loans. I’ll be using the terms interchangeably throughout this guide.

Professionals in the private money/hard money industry use “private money” to describe this type of loan while most real estate agents, conventional mortgage lenders, and borrowers call it “hard money.”

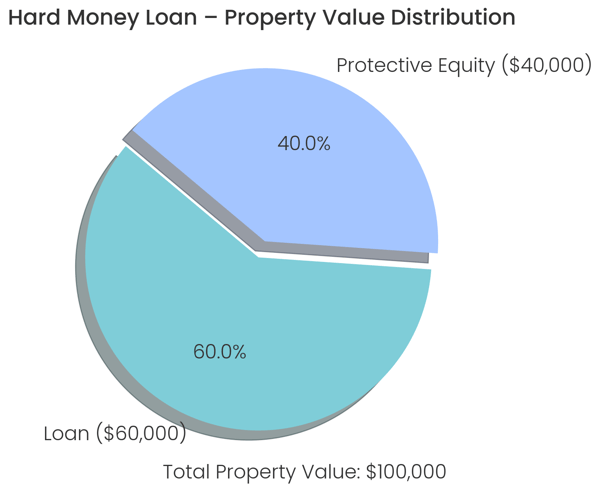

A hard money loan refers to a strictly asset-based loan where the loan amount is determined by the protective equity in the property.

While private money loans are based on equity too, they also factor in the borrower’s creditworthiness, experience, and liquidity, which I’ll cover in greater detail below in the “How to Get Approved for a Business Purpose Hard Money Second Mortgage.”

Most hard money and private money lenders want to know some – or all – of these additional details about the borrower. The more information, the more likely the loan will be correctly priced, minimizing the risk of default. Very few hard money or private money lenders want to make a loan with a high probability of default.

How Do Hard Money Second Mortgages Work?

Hard money (and private money) second mortgages work like short-term bridge loans (12-36 months) but fall in second position on title behind the first mortgage. Business purpose hard money second mortgages are created as temporary solutions for business owners or real estate investors, rather than long-term financing options offered by banks and credit unions for consumer purpose second mortgages like debt consolidation or home improvement loans.

FCTD originates the following types of hard money second mortgages:

- Fixed-Rate Second Mortgages

- Private Money HELOCs (California-only)

Fixed-Rate Hard Money Second Mortgage

As the name suggests, a fixed-rate second mortgage has a fixed interest rate during the 12-36-month loan term.

Private Money HELOC

The hard money HELOCs that FCTD originates in California only often have an adjustable interest rate over the 12-36 month life of the loan. The two or three lenders we work with lend off a floating rate revolving credit facility with a bank, either secured by their mortgage fund, or other assets. One trust deed investor has a margin account secured by their stock portfolio, with an adjustable rate that can be tied to LIBOR or Treasuries.

Borrowers who use HELOCs will pay interest on the upfront closing costs and any funds drawn against the line of credit. Unused funds from the HELOC will not incur interest charges.

Most Common Borrower Problems with Business Purpose Second Mortgages

Since we’ve originated a few hundred hard money second mortgages, we’ve noticed some common problems borrowers confront when applying for, or after they’ve taken out a business purpose second trust deed.

Hard Money Second Mortgages are Expensive

There’s no way around it – hard money second mortgages are expensive loans. The upfront fees and the cost to service the debt each month can be cost-prohibitive.

Every now and then, real estate investors and business owners run into cash flow crunches. When that happens, they have to prioritize which bills to pay first. They often choose to skip the private second mortgage because it doesn’t appear on their personal credit report. But when payments are more than 10 days late – let alone 30 or 60 days – the lender in second position will notice and become concerned.

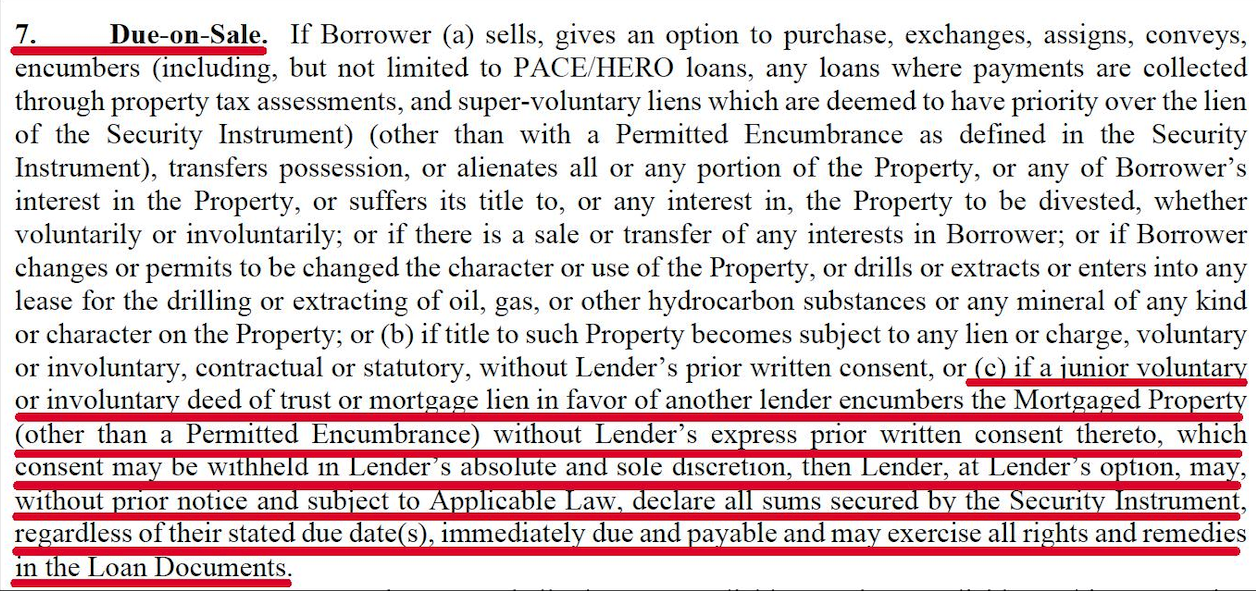

The First Mortgage May Not Allow a Junior Lien

There are many hard money first mortgage lenders that don’t allow junior liens, including the lenders we draft loan docs for at FCTD.

Here’s the language in the “Due-on-Sale” section of the Note regarding junior liens:

The Combined Loan-To-Value (CLTV) Request is Too High

Many people seek high-leverage second mortgages above the 60-65% CLTV maximum threshold. It’s common to see requests for 80-90% CLTV, which banks and credit unions may consider, but is too high for private lenders.

Funds are Really for Consumer Purposes

It’s always problematic when borrowers request a consumer purpose second mortgage to pay off credit cards, finish an over-budget home remodel, or finance some other personal or household use.

Again, FCTD doesn’t do consumer purpose second mortgages.

Some borrowers, who have been rejected multiple times because their loan is for consumer purposes, will make up a story about the funds being for business purposes. Usually something about the story is suspicious or doesn’t check out, which piques my intuition.

Borrower Wants a Second Mortgage For Down Payment and Closing Costs

The most unrealistic second mortgage requests are from buyers with no money of their own who request a loan to cover the down payment and closing costs on an investment property.

Hard money lenders don’t provide 100% CLTV second mortgages unless the borrower has additional real estate collateral that can be secured for the loan, which is known as a cross-collateral blanket loan.

Gap Funding on a Fix-and-Flip Project: It’s Incredibly Rare

Gap funding is where a house flipper obtains a high-leverage hard money fix-and-flip loan in first position but needs a “gap loan” to cover the down payment, closing costs, and renovation expenses.

Gap funding is next to impossible unless you have a house-flipping TV show or a track record of flipping 20+ properties each year. First-time house flippers or those who do 1-2 flips per year won’t get a gap loan.

Instead of seeking gap funding debt, it’s best to seek out an equity partner to join in the profits.

FCTD does not do Gap Funding Loans.

Maturity Default – Lender Will Not Offer an Extension

The 12-month second mortgage matured, the balloon payment is due, and the private lender won’t offer an extension. The borrower is under pressure to pay off the loan, either by selling the property, refinancing the second mortgage, combining the first and second mortgage into a brand new first mortgage, or paying off the loan with cash on hand or equity from another property.

Lenders can refuse to extend a second mortgage for a variety of reasons, including:

- Delinquent payment history

- Lack of communication from the borrower

- Equity erosion from declining property condition/value, or rising first mortgage balance due to default

The best practice is to be overly communicative with your lender. Communication builds a relationship of trust, which can pay off when you need a loan extension.

The 24-month term gave the homeowner time to complete the entitlements, build the street, and obtain a construction loan to build eight houses, which paid off the owner-occupied second mortgage.

| Component | Second Mortgage |

|---|---|

| Loan Amount | $150,000–$10,000,000 |

| Interest Rates | 11.00% to 15.00% |

| Term | 12-36 Months |

| CLTV | Up to 65%* |

| Origination Fee | 3-6 Points** |

| Closing | 3-14 days |

| Amortization | Interest-Only Payments |

| Prepayment Penalty | 0-6 months*** |

| Eligible Borrowers | Individuals, Trust, LLC, CORP |

| Minimum Credit Score | 650 |

| * CLTV is case-by-case. Florida is lower 55% CLTV while prime CA properties could be 70% CLTV | |

| ** Smaller loans often have a larger % than larger loans | |

| *** Prepayment penalty or guaranteed interest - depends on lender | |

| First Capital Trust Deeds is a mortgage broker and does not determine final pricing. The pricing range above reflects FCTD's experience of the marketplace as of Q4 2023. | |

The loan terms on a business purpose hard money second mortgage include the following categories:

- Interest Rates

- Term

- Closing Costs

- Prepayment Penalty or Guaranteed Interest

- Combined Loan-To-Value (CLTV)

- Ratio Between 1st and 2nd Mortgage

Minimum Loan Amount

FCTD has a minimum second mortgage loan amount of $150,000. Our average loan amount over the last six years has been $950,000.

However, we receive numerous second mortgage loan requests between $20,000 to $75,000. Small loans are just not worth our time. These borrowers tend to be less experienced with hard money lending and require more attention and resources throughout the process. Each small loan we make reinforces the inverse 80/20 principle: 80% of our time is consumed by the borrowers who account for 20% of the business. They cost the most and pay the least – which is not a smart way to work.

Interest Rates

The current interest rate range we see is between 11.00% and 15.00%.

Loan Term (months)

The normal range for hard money second mortgages is 12-36 months.

Closing Costs

The closing costs for most private money second mortgages are between 3-6% of the loan amount, known as points. Smaller loans (~$200,000) often have a higher percentage of points (~6 points), whereas larger loans (~$2 million) can have a lower percentage of points (~4 points).

Prepayment Penalty or Guaranteed Interest

Most fixed rate private money second mortgages will have a guaranteed interest clause where the lender requires a minimum number interest-only payments to be made on the loan.

For example, a $500,000 second mortgage with a 12.00% interest rate ($5,000/mo) with 24-month term may have a 4-month guaranteed interest requirement. That means that the lender will want to receive four interest-only payments of $5,000/mo. If the borrower pays off the loan after making two payments, the payoff demand will include the additional $10,000 ($5,000 x 2 payments) on top of the $500,000 principal balance.

Combined Loan-To-Value (CLTV)

Our maximum CLTV is typically 65%. Occasionally, we’ll stretch to 70% CLTV on a hard money second mortgage for an experienced borrower on a great property (California only.)

CLTV is the balance of the first mortgage and second mortgage divided by the property value.

Outside of California, in states like Arizona, Utah, Oregon and Washington, 60-65% CLTV is the max, and that’s for a strong borrower with an excellent property.

One of our investors recently cut their CLTV in Florida down from 60% to 50%, after assessing that the Florida market is overheated and the cost of insurance has skyrocketed over the past two years.

Ratio Between 1st and 2nd Mortgage

We like to stay at a 5:1 ratio between the unpaid balance (UPB) of the first mortgage and the loan amount of a new second mortgage.

Anything above 5:1 creates greater risk for the second lienholder in the event of default, where the second lender will have to foreclose their position and either pay off the first mortgage, or service the debt on the first before they sell the property or refinance the first mortgage.

How to Get Approved for a Business Purpose Hard Money Second Mortgage

As I mentioned above, hard money loans are primarily equity-based loans where the protective equity between the loan amount and property value drives the pricing and terms. The business purpose second mortgages FCTD originates for our investor clients are what we consider private money loans.

To get approved for a private money second mortgage, FCTD (as the mortgage broker), and our lenders (who underwrite the loans) require that borrowers provide the following documentation:

- Credit Check

- Background Check

- Liquidity

- Experience/Track Record

- Cash Flow (leases, rent roll, etc.)

- Budget (rehab or construction)

- Business Plan with Timeline

- Exit Strategy

- Note (first mortgage) & Mortgage Statement

- Valuation

Credit Report

Most of the private second mortgages FCTD originates are for borrowers whose personal credit scores are 650 and above, with the majority having 700+ FICO scores. Hard money loans for borrowers with bad credit in the 500s is less common than it was prior to the 2008 crash. Most trust deed investors and private lenders want borrowers with good credit because it increases the likelihood that they’ll pay on time and ultimately be able to refinance the private loan (see exit strategy below).

Background Check

The background check needs to be clean and show real estate experience. Items on a background check that can cause concern include:

- Financial Fraud – immediate disqualification

- Criminal Indictment(s)

- Multiple Bankruptcies, NODs (Notices of Default), and/or Foreclosures

- Judgments and Income Tax Liens

- Litigation – plaintiff and defendant

Over the years, I’ve seen countless background checks where people had financial crimes, felonies, multiple foreclosed properties through numerous bankruptcy filings over many years, unpaid income and property taxes, and an extensive litigation history of either suing or being sued. These are hard situations to overcome – especially on a second mortgage – where the risk to the lender is higher.

Liquidity

We verify borrower liquidity on each private money second mortgage. With interest rates in the 11-15.00% range, the payments can be expensive. We ensure that the borrower has a high likelihood of making on-time monthly payments.

Experience/Track Record

Business purpose hard money second mortgages are for business use or real estate investment. FCTD vets for borrowers with previous real estate experience with successful outcomes. This is crucial when taking out a second mortgage to renovate a vacant building or some other higher risk scenario.

Cash Flow (Rent Rolls, Leases, P&L)

For second mortgages against properties with existing cash flow, borrowers should expect to provide the rent roll, copies of fully executed leases, and a year-to-date (YTD) Profit and Loss (P&L).

Rehab Budget

If the second mortgage is going to fund renovations, you’ll need to provide a budget from the general contractor. For larger rehab budgets, the lender will require a fund control account with a third party administrator to manage construction draws and ensure the work is complete – which protects the lender’s security in the property.

Business Plan with Timeline

The business plan can be simple, but needs to have realistic timelines. If local permits are taking six months, the timeline shouldn’t say you’ll have permits in two months.

Exit Strategy

How will the second mortgage be repaid? Will you sell the property or refinance with a bank or institutional loan?

We evaluate borrowers’ exit strategies, checking with local real estate agents to see if the target sale price checks out and with institutional lenders to see if the borrower has a high probability of obtaining a conventional mortgage. It’s important that the borrower can actually obtain the financing in their plan.

Note on the first mortgage and most recent mortgage statement

We check the Note on the first mortgage to make sure that the first lender will allow a junior lien. Some have an acceleration clause if a voluntary second mortgage is recorded on title, which allows the lender to demand full and immediate repayment of the outstanding mortgage.

FCTD also verifies the most recent mortgage statement. With private loans, which are not reported to personal credit reports, the mortgage statement confirms that the loan is current and in good standing.

Property Valuation

Valuations come in the following forms:

- Appraisal

Generally required by lenders who lend from a credit facility or originate and sell to investors in the secondary market. - Automated Value Model (AVM)

Some lenders, including mortgage funds, will run an AVM on the property. FCTD often runs AVMs in House Canary, which provides in-depth market information about the subject property and comparables. - Broker Price Opinion (BPO)

BPOs can be ordered through third party providers like Clear Capital or through a local real estate broker. FCTD and our lenders will use BPOs to get a valuation from a local expert. - Due Diligence

Some of FCTD’s lenders, many of whom have real estate and finance backgrounds, will do their own due diligence on the property by accessing the MLS, driving by the property, or contacting the listing agent (past or present). - Site Inspection

A few of FCTD’s lenders will do a site inspection, meeting the borrower at the property to get a sense of their character and to document the property’s condition.

Conclusion

Hard money second mortgages are a financial tool that gives borrowers access to funds to improve or purchase business-purpose and investment properties. While many people inquire about these mortgages to help solve a personal financial situation, hard money second mortgages are designed for business owners and real estate investors.

Like any hard money loans, these second mortgages are shorter duration (usually 12-36 months), with higher interest rates. While loan approval, pricing and terms are contingent on the protective equity in the property, hard money lenders also examine the broader picture: including the borrower’s experience and creditworthiness, the property’s condition and value – and whether a second mortgage is even allowed by the first lienholder.

At FCTD, we hear from many people who see hard money second mortgages as their ticket to access capital to improve or buy property. Ultimately, whether a mortgage is made depends on the purpose of the funds, the borrower’s bonafides – and if the numbers make sense for the lender.

FAQ: Business Purpose Hard Money Second Mortgages

-

In what states does FCTD originate business purpose hard money second mortgages?

The majority of FCTD’s second mortgages are secured by properties in:

- California

- Oregon

- Washington

- Arizona

- Florida

- Colorado

- Texas

Outside of the West Coast and Sun Belt states, we don’t have much success originating second mortgages because we don’t know the other markets as well. FCTD receives many second mortgage requests from across the country, but our focus is on the states listed above.

-

Does FCTD originate second mortgages in both judicial and nonjudicial foreclosure states?

Most of FCTD’s trust deed investors and private lenders only lend in nonjudicial states. The nonjudicial states generally have a faster foreclosure timeline, whereas judicial foreclosure states are known to be longer and costlier to lenders trying to recoup their funds secured by real property collateral.

Several of our lenders have made loans in judicial states like Hawaii, New Jersey and Illinois, where foreclosure timelines often take much longer to move through the courts. One lender-initiated foreclosure on a second mortgage in Hawaii over four years ago with no sign of resolution. Another lender has a first mortgage in foreclosure in New Jersey going on ten years. To protect their security interest in the property, the lender has paid the property taxes and taken out force-placed insurance to protect from property losses – which when combined, have exceeded the original mortgage balance.

The two examples above are why private lenders prefer making loans in nonjudicial foreclosure states as opposed to judicial foreclosure states.

For more info about judicial and nonjudicial foreclosures, see this article from Nolo.com:

https://www.nolo.com/legal-encyclopedia/chart-judicial-v-nonjudicial-foreclosures.html -

What happens if the second mortgage lender forecloses?

If the second mortgage lender forecloses, the second lien is removed from the title and the second lienholder becomes the property owner. Once they take possession of the property, they are responsible for the first mortgage. They can choose to pay off the balance in full, make monthly payments, or refinance the first mortgage.

-

How long does it take to close a private money second mortgage?

FCTD has closed second mortgages in 3-14 days. We can close quickly when borrowers already have title and escrow opened, along with a recent appraisal. Expect two weeks if you’re starting from scratch.

-

Do you verify my income?

FCTD may verify personal income. However, since this is a business purpose loan, we’re not required to document ability-to-repay (like for a consumer purpose mortgage). But, we will verify rental income on cash-flowing properties and liquid assets.

-

If it’s a business purpose loan, why do you care about my personal credit?

Your personal credit report shows past payment history and provides more data points to approve or deny a loan.

-

Are FCTD’s second mortgages recourse or non-recourse?

Nearly all private second mortgages are recourse loans, with borrowers personally guaranteeing (PG) the debt. Most of FCTD’s trust deed investors and lenders require that the loans have a PG.

There are occasions when the loans are non-recourse, such as when the borrowing entity is a self-directed retirement account. Or an entity composed of a general partner (manager) and limited partners (investors) borrows money for a commercial building without personally guaranteeing the loan. These examples would be considered real estate syndications.

FCTD’s private money loans are 99% recourse, with one or all borrowers personally guaranteeing the loan.

-

Does FCTD offer 5, 10, or 20-year terms on private money second mortgages?

No. FCTD considers private second mortgages to be bridge loans in second position on title. They’re temporary options that investors or business owners use prior to selling a property or refinancing into long-term debt with a bank, credit union, or other institutional lender.

-

Can you build in an interest reserve to cover the monthly payments?

Yes. If we’re doing a cash-out refinance, proceeds from the loan can be earmarked for monthly payments. At closing, escrow will send the interest reserve funds to the loan servicer, which will hold funds in a trust account and apply them on the first day of each month to cover the debt service requirement.

-

If I have a hard money first mortgage, can I get a hard money second mortgage?

Yes. It’s possible, but not always definite. As mentioned above, some hard money first mortgages may have a due-on-sale clause that prohibits a voluntary junior lien like a hard money second mortgage. If your current first position Note contains that language, you’ll want to approach your first mortgage lender to see if they allow an outside junior lien. If they won’t, check if they would issue you a second mortgage without calling the first mortgage due. Or, they may be open to modifying the balance on your existing first lien to give you the cash-out proceeds you need.

-

If my second mortgage reaches maturity, can I get an extension?

Extensions are a case-by-case situation.

In a rising real estate market, a second mortgage lender may grant an extension for 3-6 months – possibly even one year – assuming the borrower has made on-time payments.

In a declining real estate market, the lender may be concerned about margin erosion (the protective equity between their loan and the fair market value of the property) and may not want to be exposed to a higher risk of loss of their principal. Instead of granting an extension, they may require that the loan be paid in full by the maturity date.

-

How many properties can I use for a cross-collateral second mortgage?

FCTD has done a private money second mortgage HELOC that used 12 rental properties to secure the loan.

Hypothetically, we could use up to 50 properties. But at that point, the amount of work required for that cross-collateral second mortgage would probably outweigh any benefits of using 50 properties for a second loan.

-

Why doesn’t FCTD do gap funding second mortgages for fix-and-flips?

Simply put, the people who usually request gap funding second mortgages have no money or experience flipping houses.

The people who can get gap funding second mortgages, (like those with house flipping shows on TV) don’t contact FCTD for financing. They have a network of investors, usually high-net-worth individuals (HNWI), who lend money against fix-and-flip projects for a fixed rate of return (12-15%) plus a percentage of profits (20%).

-

Will FCTD lend against a fix-and-flip project that went over budget?

It’s possible. FCTD has originated second mortgages for several long-time house flipper clients when their projects went over budget.

The first thing we do is check the due-on-sale language on the Note. Then, we review the property condition and estimated value. Usually, we’ll use another property as additional collateral for the second mortgage.

-

Can I get a second mortgage to bring my first mortgage out of foreclosure?

Though probably not from FCTD, you might find another mortgage broker or hard money lender who can assist you with this request.

FCTD has been burned too many times on foreclosure bailout loans and makes it a practice not to get involved in this type of scenario. Borrowers usually re-default and then sue everyone who helped them get into the loan, from the broker, lender, escrow and title company, loan servicer, etc.

-

Why won’t FCTD do a consumer purpose hard money second mortgage?

It’s just not something we choose to do.

For borrowers with properties in California, Marquee Funding Group is a great option if you need a consumer purpose private money second mortgage.

-

Will FCTD provide a second mortgage behind seller financing?

Most of the time we receive this request, the seller is willing to carry a loan in first position up to 75-80% LTV, and the borrower wants a hard money second mortgage for the down payment and closing costs up to 100% CLTV.

FCTD and our lenders cap the CLTV on private money second mortgages at 65%, making this arrangement unworkable for us.