Guide to Hard Money Loans

If you’re new to hard money lending and embarking on your first online search of the topic, this guide to hard money loans is for you. I’ll cover all aspects of hard money loans and reference other blog posts I’ve written for more in-depth details on everything a future hard money borrower should know.

-

In this guide, I’ll cover the following hard money loan topics:

- I. Introduction to Hard Money Loans

- II. Features of Hard Money Loans

- 1. Pricing, Interest Rates, Fees and Closing Costs

- 2. Appraisal Requirements

- 3. Do Hard Money Lenders Verify a Borrower’s Credit?

- 4. Do Hard Money Lenders Report to the Three Credit Bureaus?

- 5. Interest-Only Payments

- 6. Personal Guaranty

- 7. Prepayment Penalty and Interest Guarantee

- 8. Interest Reserve

- 9. Balloon Payment

- 10. Exit Strategy

- III. Important Information About Hard Money Loans

- 1. Direct Lender or Mortgage Broker?

- 2. Who is a Good Fit for a Hard Money Loan?

- 3. Who is a Bad Fit for a Hard Money Loan?

- 4. Hard Money Loans and Bad Credit

- 5. Five Common Mistakes Borrowers Make With Hard Money Loans

- 6. Is a Hard Money Loan Considered Cash?

- 7. Borrower Requirements for a Hard Money Loan

About the Author – Ted Spradlin

Before I dive into the details, I’d like to introduce myself. My name is Ted Spradlin, and I’m one of the co-founders of First Capital Trust Deeds (FCTD), which is a private money, or hard money, mortgage brokerage based in California.

Before I dive into the details, I’d like to introduce myself. My name is Ted Spradlin, and I’m one of the co-founders of First Capital Trust Deeds (FCTD), which is a private money, or hard money, mortgage brokerage based in California.

I happen to live in beautiful Bend, Oregon. The company’s focus is mortgages for real estate investors, originating hard money loans for our clients who are actively buying, selling, renovating and stabilizing properties.

For clients who want to retain a property and pay off their hard money loan, FCTD secures long-term institutional financing that increases the return on investment over the long run. We don’t put people into hard money loans if we don’t think we can get them out of them.

In my role with FCTD, I’ve originated several hundred private and institutional loans. I also manage all the backend details of the business, from licensing and software automation — in addition to writing every word on the website. I’ve been in the mortgage business since 2002, and have learned a lot over the years. I’m always seeking out more knowledge to improve and share with people interested in hard money lending.

1. Introduction to Hard Money Loans

In this first section, I’ll cover the basics of hard money loans, including what they are, why people use them, where the money comes from, and why it’s important to know whether they’re for business or consumer purposes.

What is a Hard Money Loan?

A hard money loan, or private money loan is a short-term loan secured by real estate and funded by a private individual, multiple individuals, or a private money mortgage lender. The loan length is usually 6-24 months of interest-only payments, with a final balloon payment at maturity.

Unlike traditional loans, hard money loans are typically asset-based — meaning funding is based on the borrower’s available equity and/or the value of their existing properties over other factors. Lenders do require due diligence, sometimes including inspections and appraisals, but it’s typically less extensive. Hard money loans can help fund time-critical projects quicker and more nimbly than the slower churn of a traditional bank loan.

Why do People Use Hard Money Loans?

If you’re brand new to hard money (or private money) lending, you’ll probably be surprised how common they are with real estate investors. Active investors, whether house flippers, home builders or real estate developers, all run into situations when they can’t borrow from the bank and instead use hard money loans.

Below are 20 examples of when someone may need a hard money loan:

- Acquiring a property mid-construction

- Unfinanceable property condition (roof) and low credit scores (550 FICO)

- 3-day Notice to Perform

- Staying competitive in a hot seller’s market (i.e. San Francisco)

- Recent business acquisition reflecting large loss on personal income taxes

- Buying mixed-use property with 30% occupancy

- PPP loans from 2020 causing problems in 2022

- Buying an empty warehouse

- Partially completed industrial building

- Fix and flip financing

- Owner occupied second mortgage for business expansion

- Financing a building for cannabis operations

- Bridge to sale – newly completed condo project

- New construction spec home

- Reverse 1031 transactions

- Land acquisition – cross-collateral bridge-to-construction loan

- Buying property through solo 401K plan (non-recourse loan)

- Prop 13 Effect – buying out family member(s) to maintain low property tax basis

- Apartment building acquisition and renovation

- Paying off seller financing

I dive into the details of these 20 examples in this blog post. Here you’ll find out some of the transaction-specific or property features that led the borrower to private financing over a bank or institutional loan.

The Different Types of Hard Money Loans

There are eight different types of hard money loans that FCTD has originated over the past decade:

- Bridge Loans

- Cross-Collateralized Blanket Loans

- Commercial Property Loans

- Construction Loans

- Fix & Flip Financing

- Owner Occupied Loans

- Rental Property

- Second & Third Mortgages

1. Bridge Loans

Bridge loans are usually 6-24 months long and meant for a fast-closing acquisition, buying an unfinished property, or pulling money out of a property to renovate prior to listing for sale.

2. Cross-Collateralized Blanket Loans

Investors use hard money cross-collateralized blanket loans to leverage the equity in an existing property to buy a new property or rebalance the debt across their loan portfolio. FCTD has originated numerous hard money blanket loans for acquisitions, and long-term cross-collateralized bank loans across entire rental property portfolios, doing as few as two rentals on one loan to 30 properties in a blanket loan.

3 .Commercial Property Loans

Hard money loans can be used for a wide range of commercial uses. FCTD has worked with real estate investors who needed short-term financing on the following types of property:

- Apartments

- Assisted Living Facilities

- Cannabis/MMJ Properties

- Condotels

- Gas Stations

- Hospitality/Hotels/Motels

- Land

- Medical Office Buildings

- Mixed-Use

- Office Buildings

- Retail Buildings

- Warehouse/Industrial Buildings

4. Construction Loans

Hard money construction loans can be used for both residential and commercial properties. They include mid-construction completion loans on partially finished properties, like this one below.

Or, they can be ground-up construction for one or several spec homes in a new development.

Or, they can be ground-up construction for one or several spec homes in a new development.

5. Fix & Flip Financing

FCTD has many fix and flip real estate investor borrowers who actively buy and sell 5-10 properties each year. Their primary financing need is for high-leverage debt to acquire fixer uppers. But as time goes on, projects get delayed or their business evolves, they may need bridge, blanket, construction or rental loans ― or even financing for their primary residence.

6. Owner Occupied Loans

Owner occupied hard money loans are consumer-purpose, and therefore uncommon. Most hard money lenders only originate business purpose loans. (More on this below.) However, the need occasionally arises for an owner occupied bridge loan. Self-employed borrowers may acquire a property through a hard money loan, then file their taxes to minimize deductions and show higher income ― all in order to qualify and refinance into a traditional bank loan. Or, in the highly competitive seller’s market of the pandemic years, buyers would gain an edge with an owner occupied hard money bridge loan offer, with an attractive 14-day closing window.

7. Rental Property

Investors use hard money rental property loans as a stop-gap solution on properties that aren’t ready for long-term institutional financing. If one of the tenants is in the cannabis industry, bank financing may not even be possible. FCTD sees the following situations most commonly for rental property hard money loans:

- Vacant property

- Cannabis tenants

- Fewer than four years removed from a bankruptcy or foreclosure

- Recently divorced

- Inherited a rental property or portfolio of rental properties

- Credit scores temporarily too low for conventional or non-QM loans

8. Second & Third Mortgages

Hard money second and third mortgages are mostly used on rental properties or in a cross-collateral situation where one property’s significant equity allows for a new purchase or cash-out to renovate a property in disrepair. Hard money second mortgages are almost always to help real estate investors accomplish a specific need like renovating or investing in a new business. You’ll be hard-pressed to find a hard money second mortgage to pay off credit cards, or cover the down payment and closing costs for a new house. These examples are considered consumer-purpose, which I’ll cover below.

The Different Types of Hard Money Lenders

There are five different types of hard money lenders making loans to real estate investors:

1. Individual Trust Deed Investors

Private individuals making short-term hard money loans usually work with mortgage brokers like FCTD. These investors are mostly high-net worth individuals with backgrounds in real estate, finance, law, entertainment ― or all the above. They’re real estate investors who know what makes for a secure loan. They work with a few mortgage brokers to either fund new loans or acquire already-funded loans.

2. Real Estate Investors Lending Money

There are numerous real estate investment companies with private mortgage lending arms, designed to make specific types of loans on certain property types. For example, FCTD works with a large apartment investor that only does second mortgages on apartment buildings. FCTD also works with a large Southern California residential developer that lends about $50 million on trophy homes in Los Angeles and Orange counties.

3. Family Offices

Family offices are similar to real estate investors lending money. They often have large real estate holdings acquired over many decades and also a mortgage lending division. When the real estate market heats up and cap rates on commercial properties become unsustainable, they’ll lend their money out rather than acquire property for prices they deem too high.

4. Conduit Lenders

The most common place you’ll find conduit lenders is in the fix and flip financing space. They often make loans off a credit line and sell these newly originated loans to secondary market investors. Thus, they’re a “conduit” from the borrower to the secondary market. Conduit lenders offer high-leverage fix and flip loans plus rehab financing for professional house flippers.

5. Mortgage Funds

Mortgage funds are licensed private mortgage lenders who provide bridge or fix and flip loans for investment properties. Most mortgage funds are run by experienced real estate fund managers who have solicited high-net worth individuals to invest in their debt funds. The fund manager is often the largest investor in the fund, and they’ll bring in their friends to let them manage their money through making these short-term loans.

What’s the Difference Between Hard Money and Private Money?

You might have noticed that I’ve used both “hard money” and “private money” in this guide. These terms are used interchangeably. Realtors, mortgage brokers and borrowers say “hard money.” Professionals in this niche segment of the mortgage market say “private money.”

A hard money loan is simply a mortgage against a hard asset (real estate) where income, borrower credit or liquidity are not considered.

A private money loan is where brokers and lenders underwrite the loan, factoring in borrower credit, liquidity, track record, income taxes, an appraisal, etc. Private money loans factor in many variables whereas hard money loans, in theory, only focus on equity position in the property.

For you, the end user, the difference is semantics. Hard money or private money ― it doesn’t really matter.

Business Purpose Versus Consumer Purpose Loans (why it’s important)

If you’re buying an investment property, you need a business purpose loan. If you’re purchasing your primary residence or a second home in a vacation destination, that’s a consumer purpose loan.

Hard money and private money lenders are 99% focused on business purpose loans on investment properties for real estate investors. Private lenders who originate business purpose loans don’t want to deal with all the regulations of consumer purpose loans.

I often receive calls and online inquiries from homeowners with their primary residence in foreclosure, or who want to pay off the remainder of their Chapter 13 bankruptcy plan with hard money.

In theory, it’s possible to use a hard money loan to stop a foreclosure or pay off a bankruptcy. In practice, it’s nearly impossible ― unless the person lending the money is a friend or family member. A foreclosure or personal bankruptcy requires a consumer loan, and hard money lenders just don’t do those. I tell people in this situation all the time to stop searching online for a lender, and instead try to borrow from friends or family.

II. Features of Hard Money Loans

1. Pricing, Interest Rates, Fees and Closing Costs

When people ask me about our pricing, I tell them it depends on their specific loan scenario and where the money is coming from. I’m not being evasive on pricing. But no two hard money loans will have the same pricing and terms because there are five different types of lenders (above) making loans on numerous property types, in various phases of completion (raw land, vacant lot, mid-construction completion, major fixer-upper, new construction professionally staged and listed for sale, etc.)

FCTD has originated private money loans with pricing as low as 1 point with a 6.50% rate on a very low-leverage completed new construction home. This was during the pandemic, when interest rates went to zero and hard money rates sank to the 6.00% range for the least risky situations. However, that time has passed. Interest rates are returning to their historical norm from the outlier levels of the pandemic.

Because FCTD works with so many types of lenders, we can find the lowest pricing for a borrower. Or for a difficult financing situation, we can find the one and only source of funding, where pricing will be much more expensive.

I go into detail about all the pricing, interest rates, fees, and closing costs in this guide.

2. Appraisal Requirements

Hard money lenders sometimes require a formal appraisal. It really depends on where the money is from. Individual trust deed investors, real estate offices and family offices will often do due diligence by checking the Multiple Listing Service (MLS), Zillow or Redfin for purchase transactions. They may also want to meet the borrower at the property for a site visit.

Conduit lenders nearly always require a full appraisal since their money is coming from a bank credit line with covenants requiring an appraisal for each loan. The secondary market buyer of conduit lender mortgages may also have a bank credit line that further mandates the appraisal.

Mortgage funds can go either way. FCTD works with funds that use House Canary for property analysis while others want an appraisal. Still others will do their due diligence and walk the property with or without the borrower present.

3. Do Hard Money Lenders Verify a Borrower’s Credit?

Yes, they do want to know what the borrower’s personal credit looks like. The last thing a hard money lender wants is a repeat offender who serially pays bills late to create unnecessary headaches when the loan inevitably defaults.

Taking it one step further, mortgage funds and conduit lenders will order a background check to provide additional information, like criminal history, lawsuits, foreclosures on other hard money loans that don’t appear on a credit report, and much more. FCTD will run the background check on new clients to make sure they’re a good risk for our long-time investors to fund.

4. Do Hard Money Lenders Report to the Three Credit Bureaus?

No, hard money lenders don’t report to the three credit bureaus. I guess it’s possible, but it’s rare.

However, if you’re applying for an institutional mortgage from a bank or a non-QM lender, the hard money loan will appear on an asset search even if it’s not on your personal credit report. You may be asked to provide a Verification of Mortgage payment history (VOM) to the lender if you signed a personal guaranty on a loan taken out by your LLC. (see #6 Personal Guaranty).

5. Interest-Only Payments

Nearly all hard money loans have interest-only payments. The loans are short-term in nature with interest rates starting at 10.00%, so paying both principal and interest each month won’t make a big dent in the balance like an amortizing loan at 5.00%.

6. Personal Guaranty

Most hard money loans have a personal guaranty, even if the borrower is an LLC or corporation. As I mentioned in #4 about reporting to credit bureaus, a bank or traditional mortgage lender may require a VOM to confirm on-time payment history because that individual personally guaranteed the debt (even though the borrower was technically their entity).

The personally guaranteed hard money loan can also count against a person’s debt-to-income ratio or reserve requirement on a bank loan. This scenario unfolded when I was helping a home builder finance a new primary residence. The builder had about $3 million in hard money construction loans he personally guaranteed. The bank lender required that the builder have 12 months of additional liquidity reserves ($300,000) to qualify for the new loan.

7. Prepayment Penalty and Interest Guarantee

Some hard money loans will have an “Interest Guarantee” ― another way of saying prepayment penalty. This guarantees a minimum number of payments the lender wants to receive over the duration of the loan.

For example, a 12-month bridge loan may have a two-month interest guarantee, meaning that the lender wants to receive two payments. If the borrower pays off the loan five days after making the first payment, the payoff demand will be for the original note amount plus one more payment ― the interest guarantee.

Traditional loans have a prepayment penalty for a certain number of years. Short-term hard money loans have an interest guarantee for a certain number of months.

8. Interest Reserve

Interest guarantee and interest reserve – this seems confusing!

An interest reserve is simply setting aside a specific amount of money to cover the monthly payments. At the outset of the loan, a borrower may agree to set up an interest reserve account to make payments on the loan rather than mailing or sending payments electronically each month. The interest reserve does this for them.

This is most common in new construction listed for sale. A builder will refinance the construction loan with a new private money bridge for 12 months, setting aside 12 payments through closing. The money is held with the loan servicer, which applies funds to the lender’s account each month. Any surplus from the interest reserve account is credited to the borrower when the loan pays off.

9. Balloon Payment

Most hard money loans are written for 12 months. The borrower makes 11 payments at the regularly scheduled amount, while the last payment, the balloon payment, is for the 12th monthly payment plus the original principal balance.

In the example below, the original loan amount is $1,385,000 with 11 monthly payments at $12,118.75/mo. The balloon payment is for $1,397,118.75 (monthly payment plus original loan amount).

| Loan Amount | $1,385,000 |

| Interest Rate | 10.50% |

| Interest-Only Payment | $12,118.75 |

| Balloon Payment | $1,397,118.75 |

10. Exit Strategy

When you’re applying for a short-term hard money loan, you need to know how you’re going to pay off the loan ― the exit strategy. This is crucial.

If you’re going to renovate and sell the property, then a “sale” is your exit strategy.

If the vacant commercial building you’re buying doesn’t qualify for bank or life insurance company financing due to the vacancy rate, then a “refinance” is your exit strategy. (In this situation, you might want to have a 24-36 month private money bridge loan to give you time to lease out the property.)

If you don’t know how you’ll pay off the loan, you need to figure out your exit strategy. Don’t approach a hard money lender with an ambiguous or non-existent exit strategy. They won’t do the loan.

III. Important Information About Hard Money Loans

This next section answers several common questions asked by borrowers, mortgage brokers and real estate agents seeking financing for their clients.

1. Should You Work with a Mortgage Broker or Direct Lender?

First off, I’m a mortgage broker and as such, I have an inherent bias. In most cases, borrowers should work with a hard money mortgage broker like myself with licenses in several states and a company that closes over 500 loans each year. (There are several mortgage brokers who don’t know what they’re doing, and you shouldn’t work with them.)

If you’re brand new to hard money loans ― maybe self-employed, and had your bank loan turned down a week before closing on a residential property ― then you should probably work with a mortgage broker. Or, if you build and flip houses or have a rental portfolio, and face occasional delays when you need a cross-collateral second mortgage spread across a few of your properties, you’ll value the access to capital available through an experienced mortgage broker.

I know some home builders and flippers in Portland. We’ve discussed financing over the years, but they don’t need me as a mortgage broker. They’ve borrowed money numerous times from high-net worth individuals, attorneys and Portland-based mortgage funds. With a call, they can get funded in a few days, or get construction draws funded within a day. This convenience comes at a higher price, which they pay. They do call me to see what exists outside their lending sources. (My sources usually have better pricing, but require more upfront work and can’t turn around construction draws as fast.)

I dig deeper into this topic in this blog post.

2. Who is a Good Fit for a Hard Money Loan?

At some point, a professional real estate investor will need a hard money loan. Being in this niche for the past decade, we see these types of borrowers who are good fits to use private money loans.

Rental Property Owners

I have a client with 50 rental properties. In 2020, they bought six single family homes using 100% financing by combining a few of their existing rentals, owned free and clear, in a cross-collateral blanket loan. After a few months, we refinanced their newer purchases into 30-year fixed rate loans on both the new purchases and existing rentals that had been owned free and clear.

House Flippers

If you flip houses, hard money loans are your oxygen (unless you pay cash for every property and all the rehab). Conduit lenders provide high-leverage fix and flip financing to the flipper/rehabber industry.

Home Builders

You won’t see large production home builders working with private financing sources — they usually have a banking relationship. However, smaller builders who do a few spec homes each year can use hard money to fund their projects. Hard money lenders can use creative financing, like when a builder needs to break ground on their next project before their first one sells, by crossing both properties into one loan.

Land Developers

Private money loans fund many land developments, either through an actual note with monthly payments, or a lien filed on the title giving preferred equity to a private investor, who in most cases has invested multiple times in development projects. Land developers will use the private financing route over a bank because it’s easier ― even if the cost of funds is higher.

Self-Employed Borrowers

In 2013, an entrepreneur was rejected for bank financing to buy a Newport Beach rental property, despite great income and assets, and a 60% down payment. The problem? He’d acquired a new business the year before and taken a paper loss on his personal income taxes. These things happen sometimes for the self-employed, and private financing sources can serve as a bridge until they can refinance into institutional financing.

Who is a Bad Fit for a Hard Money Loan?

Most consumer purpose loan requests are, frankly, bad fits. Remember, 99% of hard money lenders will only do business purpose loans. Finding a consumer purpose hard money loan can be like looking for a needle in a haystack. Bad fits for hard money loans include these circumstances:

- First-time homebuyers whose FHA financing fell through

- Debt consolidation (credit cards, personal loans)

- Foreclosure bailout

- Bankruptcy buyout

- $5,000 loan to replace a septic system

- Hard money second mortgage to cover down payment, closing costs, moving expenses and new furniture

- Rural, manufactured home as a primary residence

- Money to make bail

- Small loans from $5,000-$50,000

Hard Money Loans and Bad Credit

Some believe that if you have bad credit and can’t qualify for a conventional mortgage, you can simply get a hard money loan. In theory, it makes sense. But in practice, it’s uncommon.

Some believe that if you have bad credit and can’t qualify for a conventional mortgage, you can simply get a hard money loan. In theory, it makes sense. But in practice, it’s uncommon.

Hard money lenders want borrowers with a good credit history because it strongly indicates they’ll make on-time payments on the new loan. A borrower with bad credit gives a lender pause. Lenders want payments paid like clockwork and don’t want the headache of chasing down delinquent borrowers (and the lies or excuses that often accompany those borrowers).

Also, borrowers with good credit have a higher likelihood of obtaining long-term bank financing if they plan to hold the property in their investment portfolio.

Five Common Mistakes to Avoid with Hard Money Loans

I frequently see the following five common mistakes borrowers make with hard money loans:

1. Not Understanding Terms and Conditions

Hard money loans aren’t complicated. However, if your only mortgage borrowing experience is a 30-year fixed rate mortgage, you might not initially understand balloon payments or other common hard money loan features.

2. No Clear Exit Strategy

To reiterate: if you don’t know how you’ll get out of a loan, we can’t get you in. The last thing any lender wants is for a loan to reach maturity (balloon payment) without the borrower able to sell or refinance to pay off the loan.

3. Overleveraged on a Property

Sometimes a lender overvalues a property and lends the borrower more than they should. Other times, a borrower convinces a family member or friend to give them more money in second, third or fourth position, only to become “upside down” or “underwater” in the property. It’s difficult to get a borrower out of this type of jam.

4. Bad Credit Score

I’ve mentioned this above and want to harp on it again: most hard money borrowers have good to great credit. Lenders care deeply about being paid off on or before the balloon payment due date. If you don’t have good credit, you’ll struggle to find hard money financing, or if you do, to refinance out of the loan.

5. Unrealistic Opinion of Your Property Value

It’s natural to think your property is worth more than it really is. In behavioral economics, this is called the endowment effect, and we’re all susceptible. Websites like Zillow and Redfin make it easy to get an idea of value. However, it’s common for people to overvalue their property based on all-time high valuations when interest rates were at all-time lows.

For example, my sister refinanced her house in 2007 and it appraised for $530,000. In 2010, she moved to a different city and listed the house for $530,000. Between 2007-2010, home values plummeted 30-40% in many markets, including Portland where she lived. I estimated her house would sell for $335,000 ― which wasn’t what she wanted to hear.

Eighteen months and two real estate agents later, her house sold for $335,000.

It’s important to factor in the present market versus time traveling back to a more advantageous market.

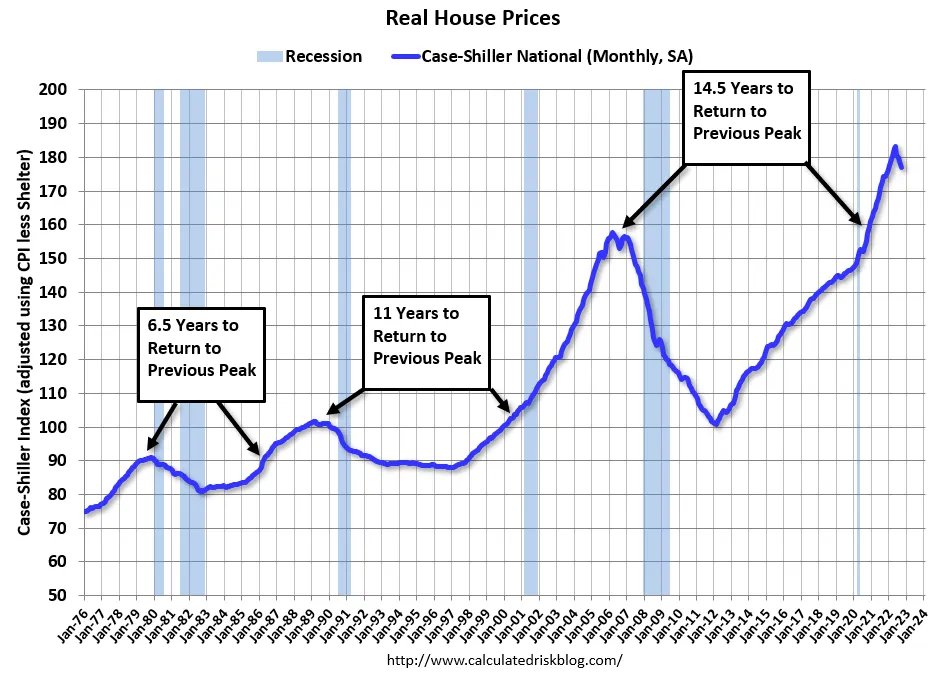

This graph below from Calculated Risk Blog is an excellent visual for how long it can take for real estate values to return to their all-time peak in real dollars.

In the current cycle, home values peaked in 2021, when residentials were as low as 2.25% to 3.00%. It may take seven or eight years, or even 15 years, before values return to the levels seen during the pandemic housing boom.

Is Hard Money Considered Cash?

If a property is in rough shape, the listing may state the property is unfinanceable (meaning no bank would lend on the property in the current condition) and ask for cash offers only.

Experienced real estate investors will submit an offer with a hard money Letter of Intent (LOI). The listing agent will verify that the hard money lender can fund in 5-10 days, which allows them to accept the privately financed offer and close. Investors use hard money to acquire cash offer-only listings all the time.

Borrower Requirements for a Hard Loan

I wrote a detailed article about all the borrower requirements needed to apply for a hard money loan. In it, I cover the items needed ― like personal information, entity documents and renovation budgets ― and why they are needed. Some loans require little, while a loan for a subdivision plus ten houses require a lot more information and details that need to be verified before closing.

The more organized you are, the smoother the process will be. To the contrary, the more disorganized you are, the longer it will take to obtain financing. Be organized and have everything, like your LLC, in good standing. And make sure to file your income taxes ― or at least your extensions ― on time.

Conclusion

In my 20 years in the hard money industry, I’ve seen a lot. Markets swing, rates change and financial policies are rewritten. Through it all, private money has offered a fast and flexible option for a wide range of investors. I hear from new people all the time, attracted to the possibilities of hard money and how it can get them the financing they desperately seek. Some will find what they need, some will not.

As a prospective borrower, it’s important to understand if your circumstances are a good match for a hard money loan, and if so, how to best position yourself to successfully secure funding. Hard money loans are typically designed for investors with the capital, leverage and experience to succeed, as well as a clear plan for the property and eventual exit strategy. For these individuals, this niche lending market can open up a tremendous opportunity to build a healthy and profitable real estate portfolio.

At FCTD, we continue to offer our experience and insight to match hundreds of investor clients with funding solutions for their projects ― or point potential borrowers to the resources they need to succeed.