As a hard money mortgage brokerage originating loans up and down California’s Central Coast, First Capital Trust Deeds (FCTD) has funded loans for real estate investors in Salinas, Monterey, Carmel, Seaside, Paso Robles, Cambria, Atascadero, San Luis Obispo, Morro Bay, Pismo Beach, Lompoc and Nipomo.

Why is First Capital Trust Deeds considered one of California Central Coast’s top private money lending providers?

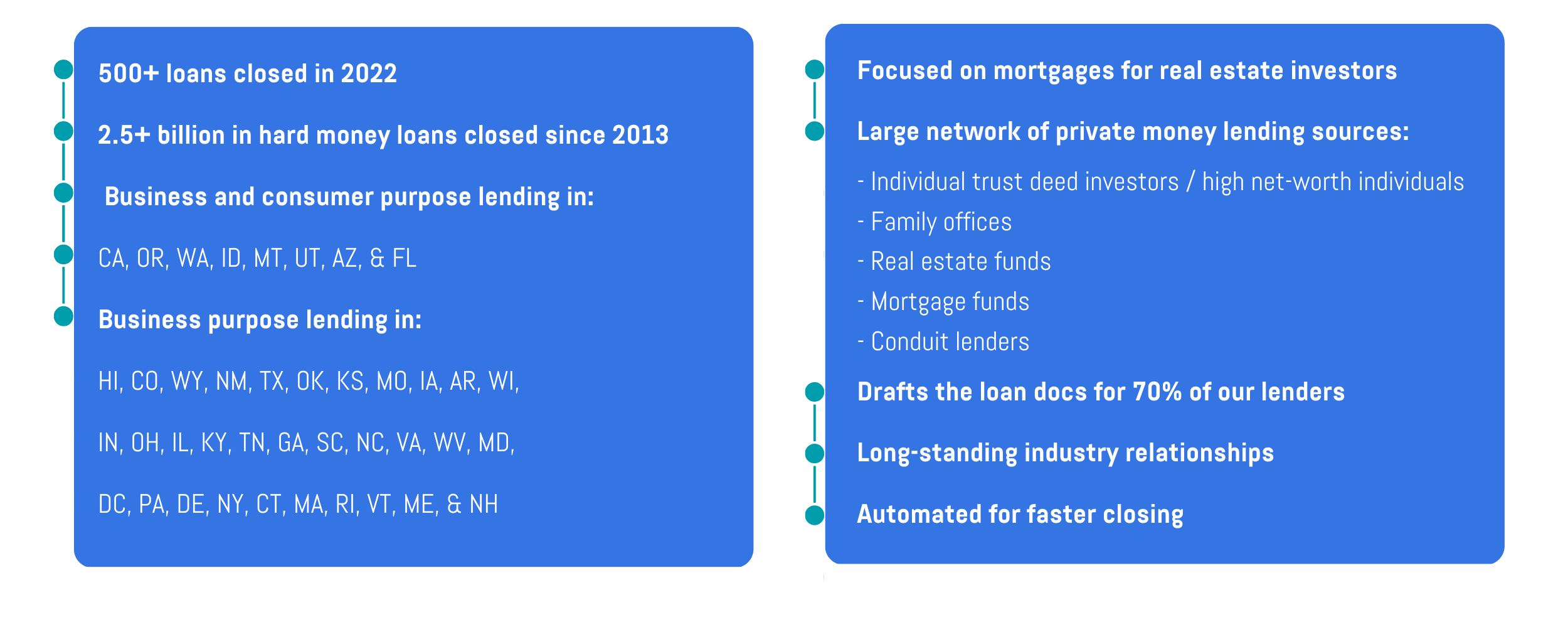

FCTD is a hard money mortgage broker with numerous lending sources to finance your real estate investments.

What Does This Mean To You?

At FCTD, we recognize how critical financing options are for real estate investors as they enhance their portfolio. In line with this, our institution features an array of loan products, from short-term hard money bridge to long-term institutional loans for stabilized properties. Our team of seasoned professionals boasts a remarkable track record of delivering successful resolutions for even the most complex financing scenarios, and reliable financing through every stage of your real estate investing.

What are the Advantages of a Central Coast Hard Money Loan?

When purchasing, refinancing, or cash-out refinancing, hard money loans offer distinct advantages over traditional loans. These benefits include expedited closing times — very useful when a conventional loan option has fallen through at the last minute or there’s a tight deadline. While hard money lenders will assess an applicant's credit profile, particularly if refinancing, the credit score is not the sole determining factor in loan approval. Hard money loans can finance purchasing and renovating non-stabilized or distressed properties ineligible for conventional bank financing. It’s important to note that hard money loans won’t be attainable for those with a history of significant delinquencies or loan defaults.

What Sets First Capital Apart

What are the Pros and Cons of Hard Money Loans?

Hard money loans are short-term financing options secured by real estate assets and funded by private investors or companies. Typically, they help facilitate real estate projects that require fast funding, such as fix-and-flips, rehabs, new constructions or refinances. On the Central Coast, the terms and rates for hard money loans vary depending on the lender and property.

Hard money loans offer several advantages, including fast-tracked approval and funding, typically within days or weeks. Additionally, they offer flexible underwriting criteria that prioritize property value rather than the borrower’s credit history or income. Furthermore, they can finance projects traditional lenders may not even consider, such as distressed or incomplete properties.

Despite their advantages, hard money loans have some drawbacks. For instance, they typically carry higher interest rates and fees compared to conventional loans. Repayment periods are shorter, usually ranging from 6 to 36 months. Lastly, hard money loans have lower loan-to-value (LTV) ratios than conventional loans, which usually range from 65% to 75% of the property value.