The Elusive 100% LTV Fix and Flip Loan

If you’re cash strapped and in escrow to purchase your next fixer-upper, you might be searching online for a hard money lender to give you the...

5 min read

Ted Spradlin

:

Feb 18, 2024 1:52:31 PM

Ted Spradlin

:

Feb 18, 2024 1:52:31 PM

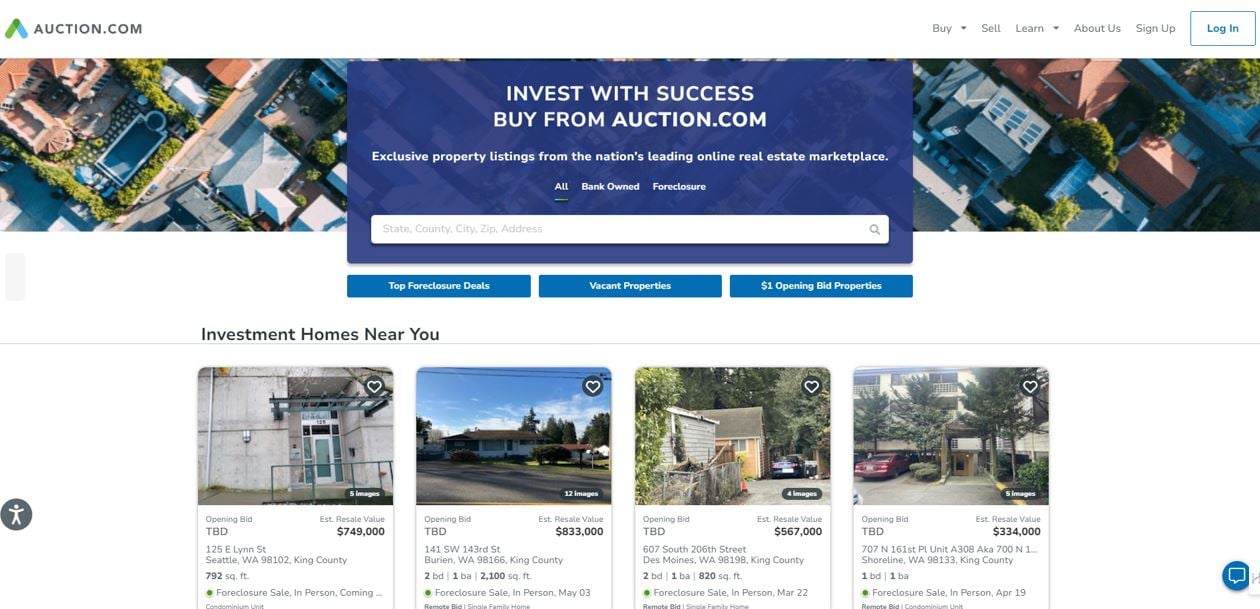

If you’re a real estate investor interested in using fix and flip financing to acquire Auction.com listings, we have all the information you'll need to get started. First Capital Trust Deeds has provided several house flippers and rehabbers with hard money fix and flip financing to close on fixer-uppers through the Auction.com website.

This blog post will cover the ins and outs of using hard money to bid on an Auction.com listing — and how to fully prepare for your next bid.

Auction.com is the nation’s leading online real estate marketplace, specializing in distressed properties. Mortgage lenders, asset managers, and banks sell distressed properties on Auction.com, including REOs (real estate owned by lender), short sales, and foreclosure auction properties.

Auction.com features properties to be sold at a sheriff’s or trustee’s sale, taken through foreclosure by Auction.com, or owned by the bank and on sale through an online bidding process.

Real estate investors can sign up for a free account with Auction.com to view listings, begin their due diligence, place bids — and hopefully win the bid for a property.

After setting up a free account, real estate investors should start saving searches, whether by zip code, city, county, or state. You’ll receive an email each time a new listing meets your search criteria.

Auction.com maintains data lists for the foreclosed properties they offer. Investors can sign up for this foreclosure tracking, and receive the data via Excel, Google Sheets, and other outputs.

If you’re buying a fixer-upper to flip on Auction.com, chances are you'll either pay cash or use a hard money fix and flip loan to close on the acquisition.

Below are the recommended steps for using hard money fix and flip financing.

The first action on your checklist is to get prequalified or preapproved for a hard money loan.

Each hard money and private money lender has different requirements:

FCTD has created a comprehensive list of all the possible underwriting items requested by fix and flip lenders, both conduit lenders and mortgage funds.

The key things you need for a fix and flip loan include:

By the way — you will need to have cash on-hand to buy an Auction.com property. Zero down payment or 100% fix and flip financing doesn't exist without an extensive track record (50+ successful projects) and a private money lender that already covers 100% of the costs on all of your flips.

If you don’t have the cash, you might want to bring in an equity partner to provide the necessary funds to finance the property with a hard money loan. Equity partners don’t need to have experience — they just need to have the cash requirement, good credit, and a clean background check.

Once prequalified or preapproved, a hard money lender issues a proof of funds letter or preapproval letter that you can provide when your offer is accepted.

The next step is to determine if you’re bidding through Auction.com on a bank-owned REO or a property via foreclosure auction — either a trustee’s sale or sheriff’s sale.

This is important because many hard money lenders, including most conduit fix and flip lenders, won't finance a property through the foreclosure auction.

In order to bid on a foreclosure sale through Auction.com’s Remote Bid mobile app with hard money fix and flip financing, you'll need to work with a mortgage fund that can wire the money into your account by 2 p.m. the day before the auction.

Before a hard money mortgage fund will agree to this financing arrangement, they'll preapprove you by confirming that your bank statements show your current liquidity covers the down payment and closing costs for the fix and flip loan.

Once you’re preapproved, you'll notify the lender of the property you plan to bid on so they can fund your account.

Here’s how the process works:

- $255,000 (85% of auction purchase price)

- 12.00% interest-only

- 12-month term

- Closing costs - 3.5 points ($8,925) + title, escrow, & recording ($6,500) = $15,425 Total

*Most hard money lenders will not finance the 5% Auction.com Buyer’s Premium fee. You'll pay that directly to Auction.com.

This process usually takes between 15-25 days.

If you're able to pay cash for the property, then refinance later into a hard money fix and flip + rehab loan (after receiving the Trustee's Deed 3-4 weeks later), you can eliminate several steps and daily interest charges. This gives you more financing options, opening the door for conduit lenders to provide lower cost capital in terms of points, fees, and interest rates.

FCTD had a client who used this strategy to acquire 15 properties at foreclosure auction on the courthouse steps during a 12-month period. The investor would pay cash on the day of the auction, and email us the receipt. We'd then open title and escrow with Linear Title in Long Beach, which would insure the property prior to receiving the Trustee’s Deed.

With this cash “recycling” program, the borrower could recoup 80-85% of their cash outlay from their auction purchase price. This allowed them to buy more properties at the auction, to either flip or keep in their rental portfolio. An investor could use this same cash recycling system through the Auction.com website.

The easiest type of property to acquire on Auction.com with hard money fix and flip financing is a bank-owned listing. The process is similar to a traditional real estate transaction and relatively simple. The only difference is that it’s facilitated through Auction.com’s site with their preferred title and escrow vendors. The closing timeline usually takes longer (30-45 days) than most traditional real estate transactions.

As a borrower using hard money fix and flip financing, buying a bank-owned property allows you to use conduit lenders that can provide you purchase financing up to 85-90% loan-to-value (LTV) and rehab funds up to 100% loan-to-cost (LTC).

One common difficulty our past clients have experienced was gaining access to the property to determine the scope of work and create a rehab budget. But if you can gain entry and grant interior access to an appraiser to complete an as-is and after repair value (ARV) appraisal, then a conduit lender with rehab financing is often the best way to go.

Summary

If you would like to use fix and flip financing to acquire Auction.com listings, you’ll need to decide if you’re going to bid on properties that are bank-owned or those going through foreclosure auction.

Bank-owned listings on Auction.com are similar to traditional real estate listings — easy to finance with hard money using conduit fix and flip lenders or mortgage funds.

Foreclosure auction properties limit your options since conduit lenders won’t finance a property on the day of auction — although mortgage funds often will. But with cash on hand, you have the flexibility to refinance a few weeks later with a conduit lender to receive cash-out funds plus rehab financing.

Your decision will ultimately come down to the type of property sale and your personal situation. Whatever that may be, you have hard money financing options available for you to acquire an investment on Auction.com.

If you’re cash strapped and in escrow to purchase your next fixer-upper, you might be searching online for a hard money lender to give you the...

Real estate investors have their choice of several private money lenders to help them acquire and renovate their next fix and flip project. However,...

If you have a seller willing to carry a note, funding your fix and flip with seller financing instead of a hard money loan is a better and cheaper...