What is a Business Purpose Hard Money Second Mortgage?

A business purpose hard money second mortgage is a type of loan issued by nonbank private lenders, including individual trust deed investors, family...

If you're a real estate investor or entrepreneur in California, a hard money business purpose HELOC (home equity line of credit) gives you quick access to capital, along with ongoing availability to funds over a one to three-year period. If you use your real estate as collateral, hard money HELOCs are a quick funding line of credit to finance real estate projects or business investments.

In this blog post, I'll cover the important details about hard money business purpose HELOCs for properties in California, including:

To define a hard money business purpose HELOC, it’s best to break down the different components.

A hard money loan is a short-term, asset-based loan secured by real estate, which is considered a hard asset. Thus, the name “hard money” loan. Whereas conventional loans are provided by banks and institutional mortgage lenders, hard money loans are provided by private lenders, which can either be individuals, multiple individuals funding a loan, family offices, real estate offices with a mortgage lending division, or a private mortgage fund that makes short-term bridge loans to real estate investors. People often use the term “private money loans” for hard money loans. They’re referring to the same thing — short-term privately funded loans secured by the hard assets of real estate.

A business purpose loan is a mortgage used for a business or investment purpose.

Examples of business purposes include:

Nearly all hard money lenders will only provide business purpose loans as opposed to consumer purpose loans, which are loans for personal or household use. Some examples include financing to purchase a primary residence, pay off personal credit cards, or make home improvements.

I go into greater detail in this blog post: Hard Money Loans: Business Purpose Versus Consumer Purpose.

A HELOC is an open-ended mortgage that allows the borrower to access funds and pay them back over a period of time. Most HELOCs from banks and credit unions have adjustable interest rates (tied to the prime rate) and are written for 25 years, giving the borrower access to funds during the first ten years with interest-only payments.

At the beginning of year eleven, the borrower must pay down the balance, as the loan converts into a 15-year amortizing (principal and interest payments) loan.

A hard money HELOC is similar to a bank or credit union HELOC in that it provides an open-ended line of credit for the borrower to access funds. However, there are some differences between hard money and bank/credit union HELOCs.

Hard money HELOCs are usually written for one to three years. Borrowers are able to access funds during this time.

As of this writing in 2023, most hard money HELOCs have an interest rate in the 10.99% to 13.00% range. In years past, when interest rates were at record lows, I’d do hard money HELOCs starting at 9.00%. Some hard money HELOCs have fixed interest rates while others use a floating interest rate based on the prime rate.

Hard money HELOCs allow a borrower to draw funds from the line of credit during the one to three years that the loan was written. If a borrower takes out a one-year HELOC, they can pull money out during that year. Same with a three-year HELOC — they’ll have access to funds during the three years of the loan.

Hard money HELOCs have a balloon payment due at the end of the term, known as the maturity date. To the contrary, bank and credit union HELOCs recast into 15-year fully amortizing loans when the 10-year draw period ends, where borrowers pay both principal and interest until the loan is paid off.

In scenarios where a borrower obtains a hard money HELOC in second position, the combined loan-to-value (CLTV) is usually limited to 65%. Banks and credit unions will usually lend up to 80% CLTV on HELOCs.

Hard money HELOCs allow investors to use multiple properties as collateral for the loan, whereas banks and credit unions usually only allow one property to secure the HELOC.

Hard money closing costs are almost always higher than bank loans. Most of the HELOCs that my company has brokered over the years have been at 3-4 points with about $2,000 in additional fees on top of standard title and escrow fees.

The most common benefits of a hard money business purpose HELOC include the following:

One of the most common reasons real estate investors use hard money HELOCs is that they can qualify with the equity in their property rather than providing tax returns and income statements. Real estate investors and self-employed borrowers often have extensive tax returns, which can take several months for a bank to underwrite. It’s common for a bank underwriter to request more conditions week after week, extending out two to three months. We’ve had several borrowers undergo the bank underwriting process before giving up and turning to a hard money HELOC — just get the loan done and gain access to their equity.

When a borrower places a draw request from their hard money HELOC, funds usually arrive in their bank account within two to three business days.

Hard money HELOCs allow a borrower to use multiple properties as collateral for the line of credit. This is known as a cross-collateral loan.

I've originated a few HELOCs for an investor with 50+ residential rental properties, some of which were owned free and clear. They took out a $1 million HELOC against seven of those properties, using the funds to close on a few single family residences with major fire damage. The HELOC gave them money to purchase and renovate the houses before refinancing into long-term rental loans.

Many 12-month hard money bridge loans will often have a prepayment penalty or an interest guarantee, where the lender requires at least two or three interest-only payments on a 12-month loan. HELOCs don’t have a penalty for early payoff or a requirement to make a certain number of payments.

A hard money HELOC can be in first or second position. I mentioned the client above who took out a $1 million HELOC in first position, secured by several of their rentals owned free and clear. That same client also took out a second position HELOC for $300,000, secured by a rental property appraised for $900,000 with a first mortgage of only $150,000.

The interest rates and closing costs are going to be higher on a hard money HELOC. Investors and business owners who utilize hard money HELOCs know this going in so they aren't surprised by the higher costs.

Some hard money lenders that offer hard money HELOCs will only do a floating rate tied to prime. The reason is that they fund HELOCs from a margin account secured by stocks and bonds. Or, a mortgage fund may have a line of credit with a floating interest from their bank secured by their fund. It’s common to see a mortgage fund with $100 million in assets obtain a $5 million line of credit and eventually obtain a $20 million credit facility. If they’re offering HELOCs, they’ll pass the floating rate along to the borrower.

Hard money HELOCs are short-term one to three year loans. They're intended for a few specific purposes only: fund a business venture; buy fire damaged homes; make down payment funds to acquire other investment properties; buy out business partners; or make major renovations prior to selling. Investors using hard money HELOCs know it’s short-term and will either pay off the loan upon selling the property or refinancing into long-term debt.

Below are a few good examples of hard money HELOCs that our company has originated over the past few years.

A Northern California landlord used seven free and clear residential rental properties as collateral for a $1 million HELOC to buy and renovate fire-damaged homes.

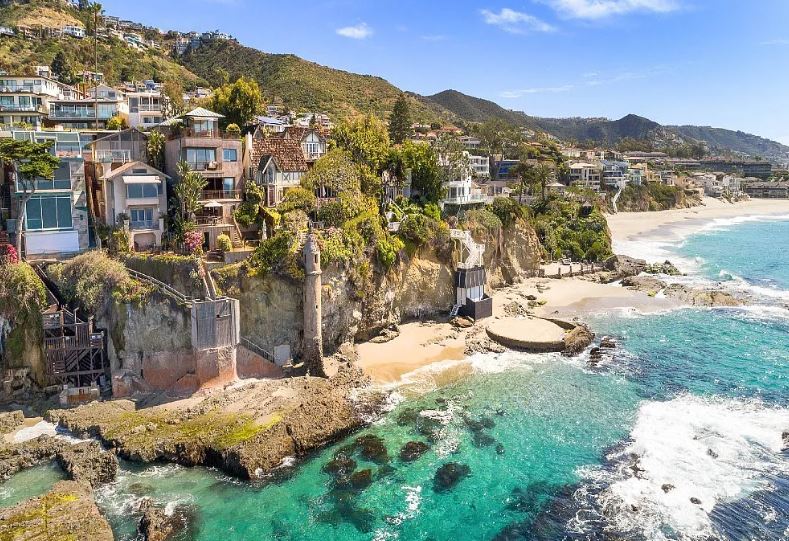

A real estate developer in Laguna Beach accessed the equity in their owner-occupied home to acquire land for their next development. The hard money HELOC allowed them to access capital within 2.5 weeks rather than the two to three months if they’d applied for bank financing.

The owner of a shopping center with a grocery store anchor took out a $400,000 hard money HELOC six months prior to refinancing the property. This allowed them to fund tenant improvements for two new tenants, which increased NOI and raised the property's appraised value.

Your primary residence or investment property must be in California to qualify for a hard money HELOC. The loan must be for business rather than consumer purposes.

Borrowers are required to provide the following documentation:

Conclusion

Obtaining a business purpose hard money HELOC secured by a property in California can be a smart choice for a real estate investor who needs quick access to capital. The trade off is higher financing costs than with bank or credit union lines of credit. Our company has originated numerous HELOCs for investors who only needed the loan for a short, one-to-three-year window to complete a specific project or acquire a property without all the red tape of conventional or bank financing.

A business purpose hard money second mortgage is a type of loan issued by nonbank private lenders, including individual trust deed investors, family...

Navigating the world of real estate investing often involves finding the right financing that fits your unique circumstances. Among the options...

A hard money second mortgage is a junior lien secured by real estate and usually issued by a private lender rather than a bank or conventional...