For real estate investors in Anaheim, hard money loans can be the ideal solution for your short-term real estate funding needs.

Why Use First Capital Trust Deeds (FCTD) for Hard Money in Anaheim?

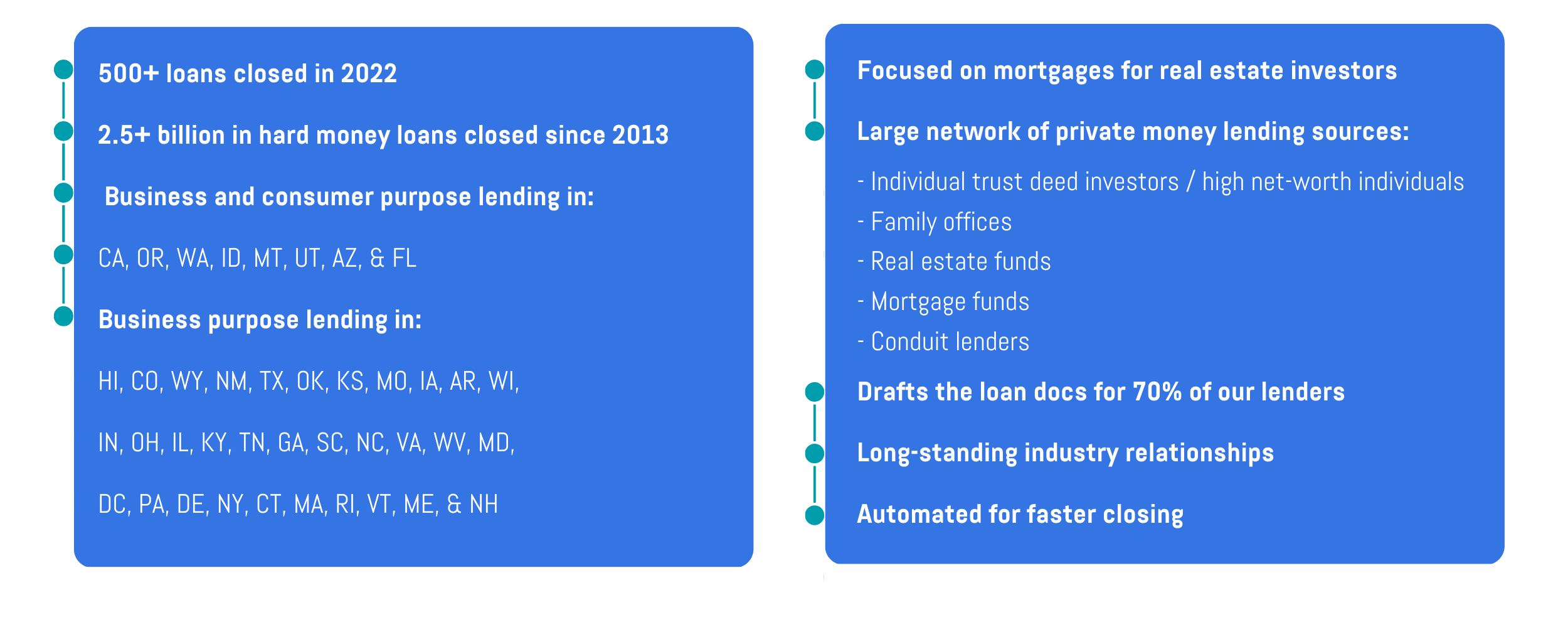

FCTD is a leading Orange County hard money mortgage broker, with an office in Newport Beach. Our hard money lending business has successfully provided financing solutions since 2013, originating more than 2,500 loans worth over $2.5 billion to date. In 2022 alone, we arranged over 500 loans for property investors across 23 states, with many from loyal, repeat customers that continue to use our services as their financing needs evolve.

Whether it's fix-and-flip projects, rental properties, new developments, or other endeavors, we work closely with our clients at every stage of their projects to determine the best financing options for them. We’re committed to helping our partners achieve their goals, and take pride in providing individualized solutions to optimize their success.

Unlike other hard money lenders who rely on a single source of funding, we have clear advantages as mortgage brokers, especially during market shocks such as the start of the COVID-19 pandemic. Our wide network of lenders enabled us to redirect loans to mortgage funds, family offices, and individual trust deed investors when conduit lenders stopped financing. We had the flexibility to protect our clients and help them move forward with their projects.

We understand that we may not always be the best option for every borrower, but we’re dedicated to matching our partners with appropriate funding that aligns with their goals. At our core, we’re a team of experienced professionals who are committed to helping our clients succeed, and we look forward to working with you on your next project.

Why Do Investors Use Hard Money Loans for Projects in Anaheim?

Hard money loans can be a valuable financing option for those seeking to purchase, refinance, or pursue a cash-out refinance. Here are some key advantages to consider:

- Expedited Closing: Hard money loans offer a quick closing process, which is especially attractive for tight deadlines or last-minute shortfalls with their bank financing. While some lenders can close a loan in as few as 24 hours, the standard timeframe is typically 5-14 days.

- Some Credit Score Flexibility: While hard money lenders will assess your credit score to determine your past payment history, it’s not always a crucial factor in loan approval. However, it’s still a hurdle if your credit score is low. If your construction or bridge loan exit strategy is a refinance, hard money lenders will want to ensure you have strong credit to be eligible for long-term bank financing to pay it off. Minor blemishes are fine, but a history of delinquencies and loan defaults will likely prevent you from getting a hard money loan.

- Financing for Non-Stabilized and Rehab Properties: Properties that are in a state of disrepair, vacant, or have high vacancy rates often don’t qualify for bank financing. However, hard money bridge loans can help investors acquire such properties for renovation or stabilization with long-term tenants.

What Sets First Capital Apart

How Much Do Anaheim Hard Money Loans Cost?

When exploring hard money loans, you need to have a clear understanding of the costs involved. While the exact fees can vary based on the lender, borrower and property, there are some common expenses to keep in mind.

First, the interest rate will be higher than for bank financing, with rates starting at 8.99% for low-leverage bridge loans all the way up to 15.00% for higher-leverage second or third trust deeds.

Another cost is upfront points, which are paid at the time of closing. One point equals one percentage point of the loan. Hard money loans can charge anywhere from 1 to 5 points, depending on the source of funds. Some lenders won’t charge upfront points whereas others will charge 2-3 points. As hard money brokers, FCTD is able to match borrowers and lenders to meet the pricing needs of both parties in the transaction.

Lastly, there are standard transaction fees such as appraisal, title insurance, escrow, recording, and more. Borrowers can choose which title and escrow provider they prefer. Some companies may even discount their services to regular real estate investors.

For more information on costs, read our Hard Money Loan Pricing, Interest Rates, Fees, and Closing Costs blog post.

What Property Types Does First Capital Trust Deeds Lend Against?