For real estate investors, house flippers and developers in Newport Beach, hard money loans are an ideal financing option for closing quickly on a property, or avoiding the lengthier underwriting of a bank loan.

First Capital Trust Deeds (FCTD) is an expert in hard money loans, originating numerous investment properties in Newport Beach, Balboa Island, Bay Island and Newport Coast since 2013.

Why is First Capital Trust Deeds Considered One of Newport Beach’s Top Hard Money Lending Providers?

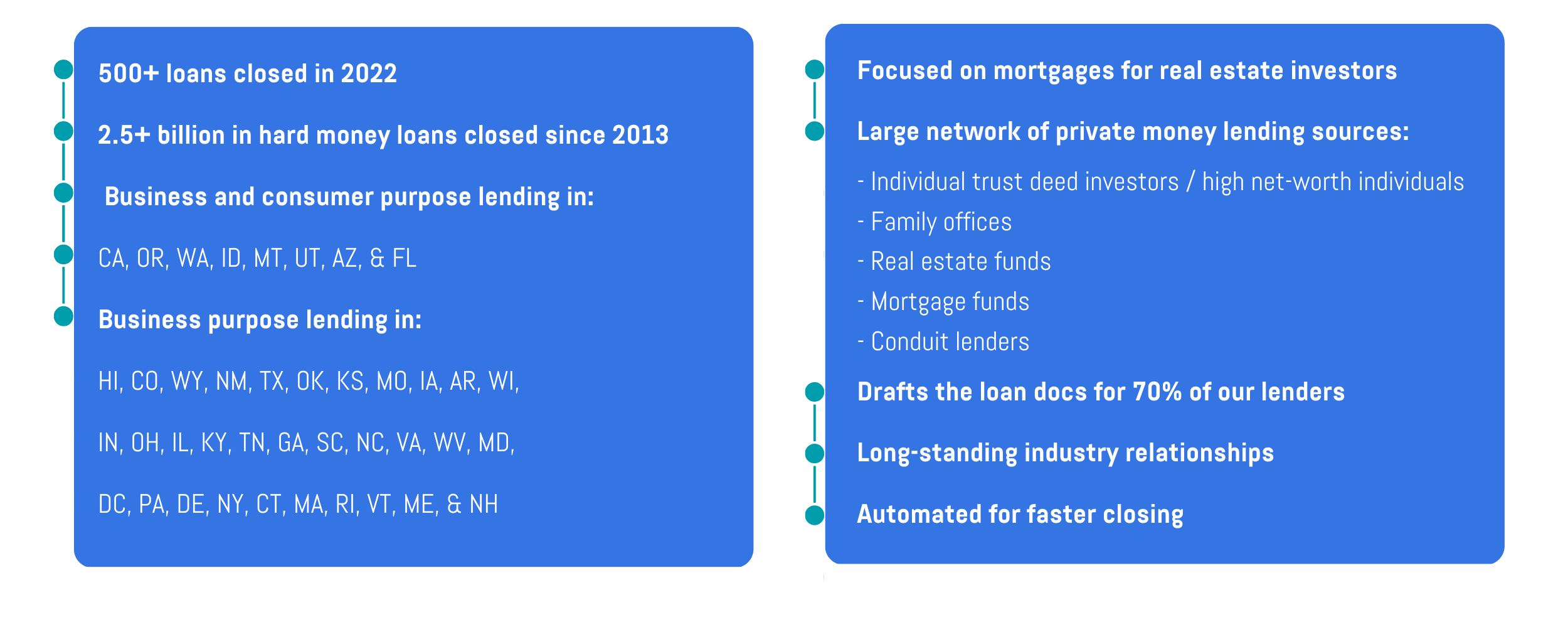

First Capital Trust Deeds is a mortgage broker with an extensive network of lending sources to finance your real estate investments. FCTD works with high-net worth individuals with backgrounds in real estate, finance, law and entertainment to fund loans. Additionally, FCTD has a network of real estate offices, family offices, local lenders, debt funds and securitization lenders that offer high-leverage financing for builders and investors.

Why Do Real Estate Investors Use Hard Money Loans?

The primary reason why investors use hard money loans is the need for speed. They need financing quickly and are willing to pay more for a loan to get it.

Some individuals may have trouble with traditional bank financing — like self-employed investors with a paper loss on their income taxes. Hard money loans help them get the money they need until they can refinance into long-term lending.

Likewise, some properties are easier to finance with a hard money loan. We see this all the time with investors acquiring vacant commercial buildings – banks won’t offer them long-term financing because there is no cash flow to service the debt. Or on the residential side, an investor will buy a fixer-upper with a lot of deferred maintenance issues, which doesn’t qualify for conventional financing, but can be acquired, renovated, and flipped or refinanced through a hard money loan.

For more information about reasons to use a private loan, read our blog post, Why Do People Use Hard Money Loans? 20 Examples.

What Sets First Capital Apart

What are the Rates, Fees, Terms and Other Costs Associated with a Newport Beach Hard Money Loan?

In Newport Beach, the costs and terms associated with hard money loans are dependent on several factors. Typically, hard money loans in this region have origination fees of 2-4 points and interest rates ranging from 8.99% to 12.00%. The loan duration can span from a brief three months up to fifteen years, especially for hard-to-finance properties such as cannabis facilities. Additional expenses may include drafting and reviewing loan documents, which costs between $1,095 for a lender or broker and $3,500 for an attorney.

Hard money loans don’t have a fixed pricing structure like conventional mortgages, but are determined by the specific borrower and property circumstances.

Several factors influence the costs and terms of hard money loans:

- Loan Type: First Capital offers eight different hard money loan types and various bank programs.

Property Type: Closing costs for a single-family home bridge loan are generally lower than for a construction loan for 10 speculative homes. - Project Scope: A $30,000 cosmetic fix-and-flip project is a simpler loan than an 18-property, cross-collateralized blanket loan involving a mix of commercial and residential rental properties.

- Funding Source: FCTD works with five different private money loan funding sources—individuals, real estate offices, family offices, conduit lenders and mortgage funds—each with their own preferences for property types and scenarios they finance, which in turn affects their pricing structure.

- Capital Availability: Complicated projects with numerous variables attract fewer lenders, increasing the cost of funds. Conversely, straightforward, low-leverage financing scenarios (less than 50% LTV) offer a wider selection of funding sources.

- Borrower Experience Level: First-time house flippers generally face larger down payments, higher closing costs, and elevated interest rates compared to experienced investors who have bought and sold multiple properties annually for an extended period.

Financial Strength of the Borrower: Borrowers with a solid financial history will enjoy a lower cost of funds than those with a history of debt defaults.

For more information on costs, read our Hard Money Loan Pricing, Interest Rates, Fees, Closing Costs blog post.

Why Do Investors Use FCTD For Hard Money in Newport Beach?

Since 2013, FCTD has originated over 2,500 loans, totaling more than $2.5 billion in funding. In 2022, we closed over 500 loans in 23 states, leveraging our knowledge, experience and professional relationships to help our clients on both sides of the transaction – borrower and lender – reach their investment goals.

We know hard money lending inside and out, and how to secure the very best financing available for our clients when they need it.

Unlike hard money lenders that rely on a single source of funding, as a mortgage broker FCTD has distinct advantages, particularly during periods of market volatility such as the onset of the COVID-19 pandemic. When conduit lenders, (who originate and sell loans to Wall Street investors,) froze new loan originations until the market turbulence settled, FCTD pivoted to mortgage funds, family offices and individual trust deed investors — ensuring our clients' projects remained on track.

While we understand that we may not always be the right choice each time for every borrower, we're dedicated to matching our partners with the best possible funding options to help them realize their objectives.