If you’re searching for investment property in Santa Barbara, hard money loans secured by First Capital Trust Deeds (FCTD) can be a viable option to acquire property throughout the area, including Ventura, Oxnard, Camarillo, Port Hueneme and Ojai.

Why is First Capital Funding considered a leading provider of hard money loans for Santa Barbara?

First Capital Trust Deeds serves as a reliable and singular source of loan origination to acquire, develop and renovate investment properties. Additionally, FCTD offers a variety of long-term loan options tailored for stabilized properties.

We understand that real estate investors often face complex circumstances that can frustrate the loan hunting process. Each investor's situation is nuanced, and so is the process of preparing the loan application. With years of experience, FCTD has successfully navigated numerous scenarios with a vast array of borrowers, securing loans through both hard money and institutional lenders. Our robust track record and extensive network of lenders empower us to find the best funding solutions for your project, even for complicated circumstances.

As a leading provider of hard money financing, FCTD remains committed to supporting the needs of real estate investors.

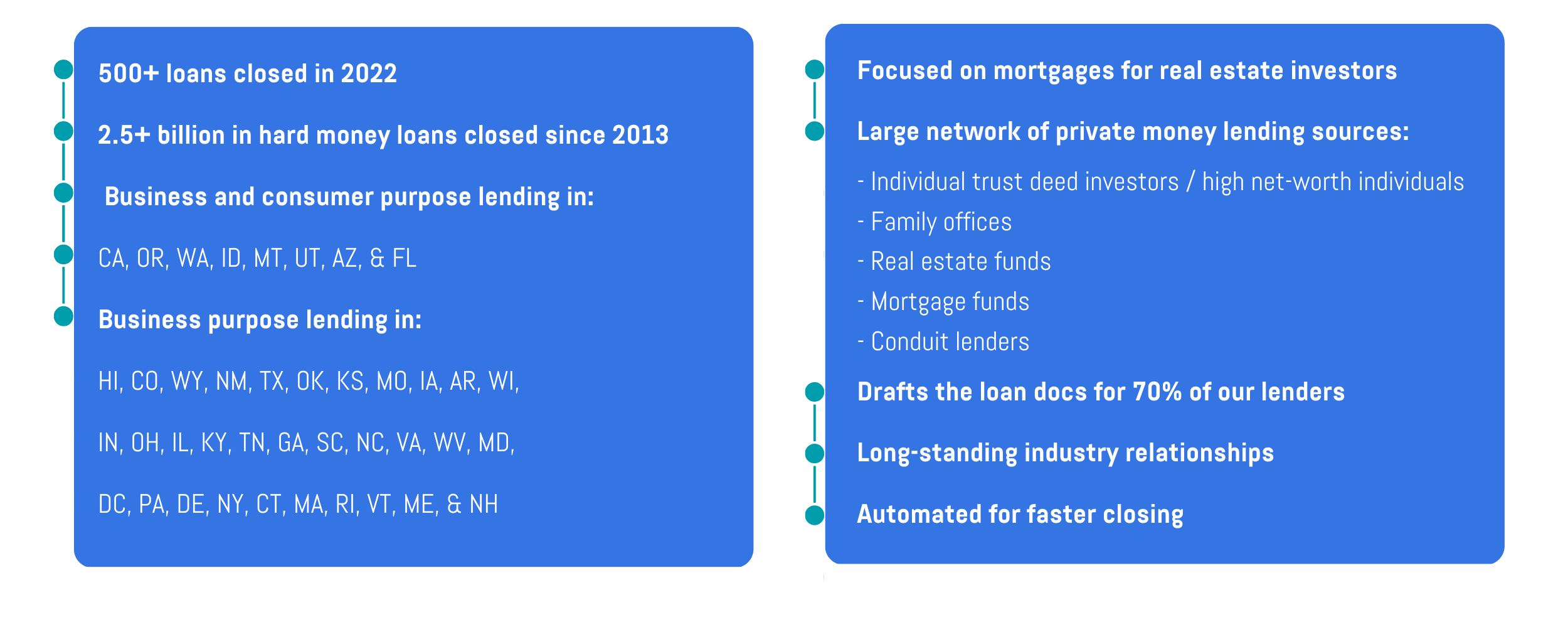

What Sets First Capital Apart

What is Typical Pricing on Hard Money Loans in Santa Barbara?

When considering a hard money loan, make sure you have a clear understanding of the costs involved. While the actual costs can vary depending on the lender, borrower and property in question, there are some common expenses you can expect.

Interest Rate: This is the fee you pay to the lender for borrowing money typically expressed as a percentage of the loan amount. Hard money loans generally have higher interest rates than traditional loans, ranging from 8.99–13.00%.

Upfront Points: These are fees paid to the lender at closing time, expressed as a percentage of the loan amount. One point equals 1% of the loan amount, and hard money loans can charge anywhere from 2 to 5 points.

Closing Costs: These are the fees you pay for various services and expenses to finalize the loan transaction, such as appraisal, title insurance, escrow, recording and more. Hard money loans can have higher closing costs than traditional loans due to additional fees or charges.

To make the most informed decision possible, we recommend comparing terms from different hard money lenders before applying for a loan. It's crucial to factor in these costs to get a clearer calculation of your potential return on investment or profit margin. By understanding the costs associated with a hard money loan, you'll be well-prepared to move forward with your investment plans and avoid any surprises down the line.

For more pricing information, please read our blog post: Hard Money Loan Pricing, Interest Rates, Fees, and Closing Costs.