Tacoma-Olympia

Hard Money Loans

As one of Tacoma’s top hard money lending choices, First Capital Funding provides short-term bridge, construction and investment financing to real estate investors in Tacoma, Olympia, Fox Island, Gig Harbor, Maple Valley, Auburn, Federal Way, Fife, Puyallup, Buckley, Bonney Lake, Lacey, Spanaway and Graham.

Why is First Capital Funding the go-to source for hard money loans in the Tacoma-Olympia area?

First Capital Funding is a hard money mortgage broker with numerous lending sources to finance your real estate investments.

First Capital Funding is a dependable source of private money financing for buying, building and restoring investment properties. When investors complete a project and want to lock in permanent financing, First Capital Funding also provides a range of long-term loan solutions.

Over the years, we’ve found that real estate investors are often confronted with complicated circumstances that make securing financing a challenge. For years, First Capital Funding has worked with institutional and hard money lenders to place loans and fund projects, navigating countless situations with hundreds of borrowers. We have a track record of successfully resolving even the most difficult financing situations with our experience and a wide network of knowledgeable trust deed investors and private lenders.

First Capital Funding is a leader in hard money financing for real estate investors.

What Sets First Capital Funding Apart:

Why Choose First Capital Funding for Hard Money Financing in Tacoma-Olympia?

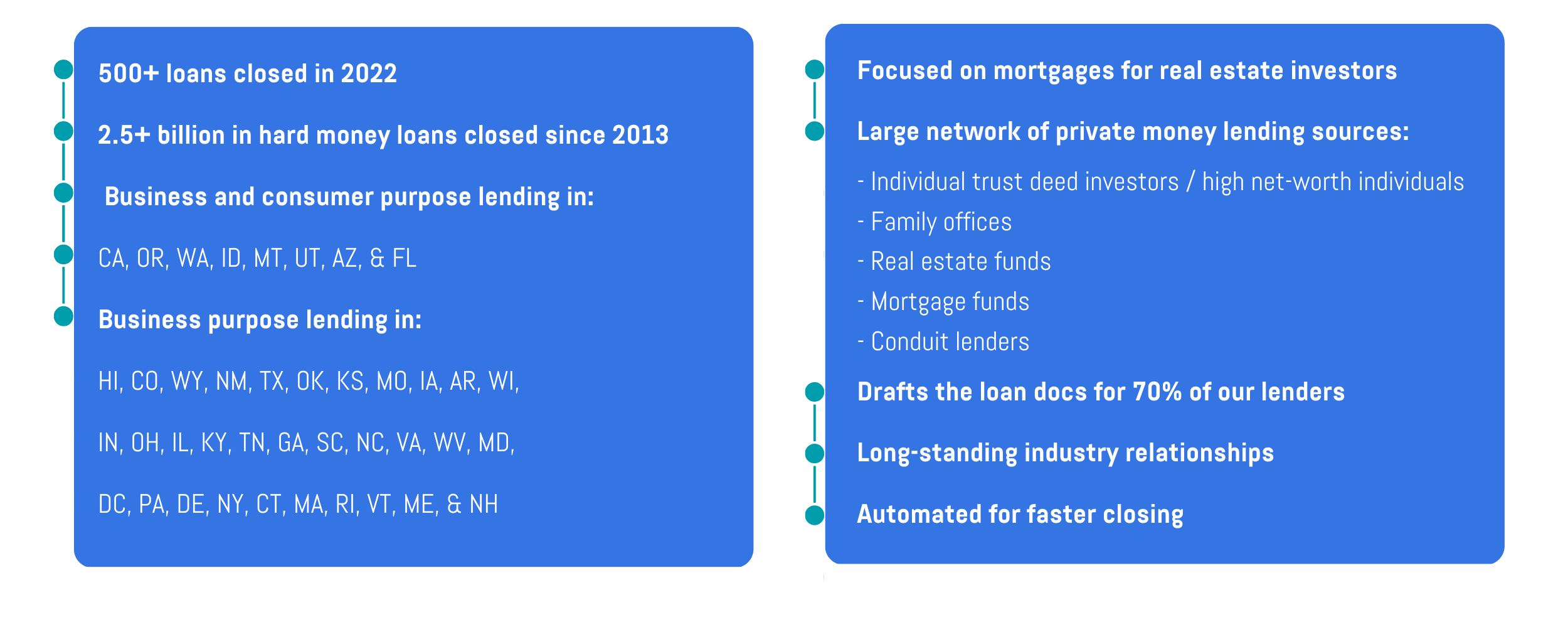

We understand hard money lending and the challenges and goals of real estate investors. Since 2013, the company has originated over $2.5 billion in mortgages for real estate investors. In 2022, we originated over 500 loans across 23 states.

Investors often come to First Capital Funding for a specific need, like a second mortgage or fix and flip financing. As time goes on, they take on new projects, or run into challenges that require outside-the-box thinking. As their investments change or expand, we’re right alongside them, helping them find the right funding for their needs. With FCF’s diverse funding sources, investors match with financing to maximize the potential of their real estate portfolio.

For example, when the financial markets froze in March 2020 at the start of COVID-19, FCF continued finding loans to fund our clients. Though several of our institutional lenders stopped funding, many of our mortgage fund and family office partners filled the financing void to keep projects moving forward.

We may not always be the ideal option for every borrower, especially those who prefer bank financing or have a single need, like subdivision financing. But we know real estate investors and have the funding sources for those who would benefit from hard money lending.

What Types of Hard Money Loans Does First Capital Funding Offer in the Tacoma-Olympia Region

Hard money loans can be used for a variety of different purposes. First Capital Funding offers the following types of loans to real estate investors in the Tacoma-Olympia area:

What Property Types Does First Capital Funding Lend Against?

What Types of Financing Scenarios Does First Capital Funding Help Real Estate Investors Solve?

Outside of the loan types mentioned above, First Capital Funding has worked with numerous real estate investors to secure financing for the following scenarios: