Texas

Hard Money Loans

First Capital Trust Deeds (FCTD) is a leading originator of Texas hard money loans, brokering loans for investors in Dallas, Houston, Austin, San Antonio and the metropolitan areas.

Why Do Real Estate Investors Work With First Capital Trust Deeds?

First Capital Trust Deeds is a dependable and comprehensive loan originator for acquiring, developing and renovating investment properties. Moreover, FCTD provides a range of long-term loan options specifically designed for stabilized properties.

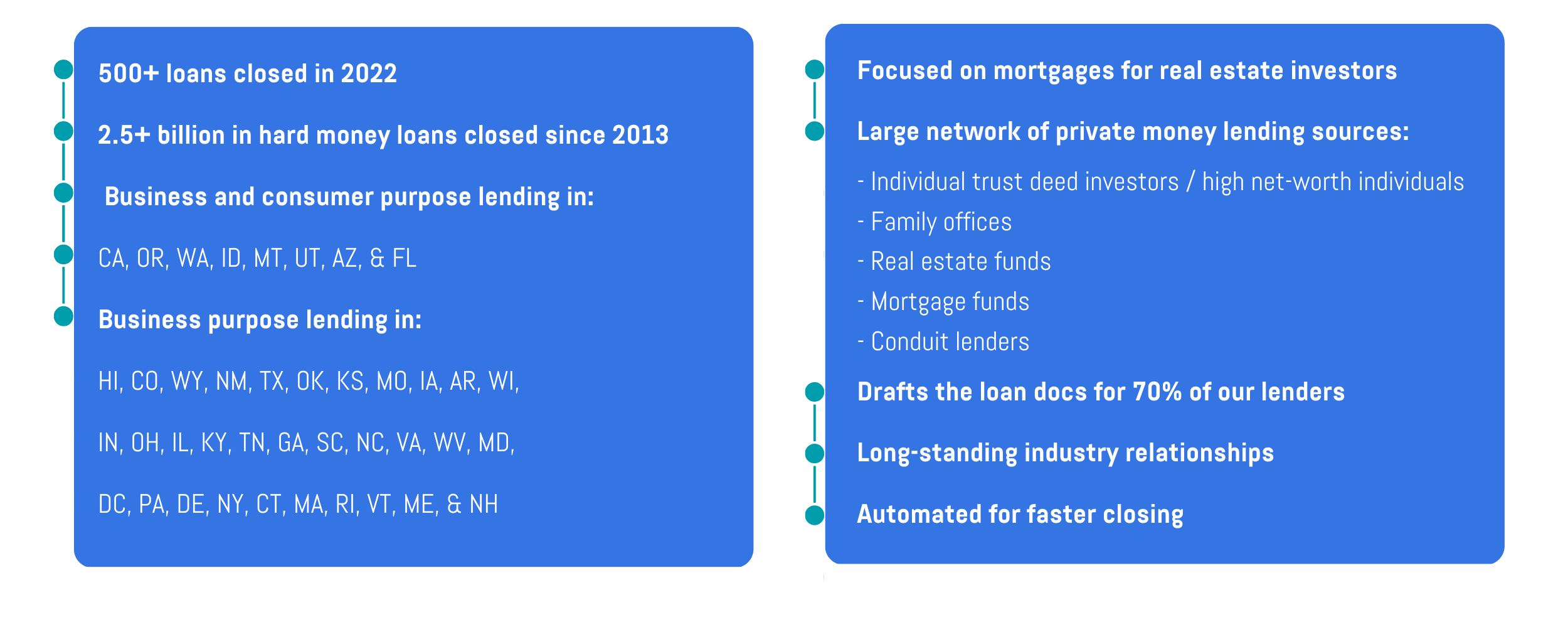

We recognize that real estate investors often encounter intricate situations that can complicate the loan process. Each investor's circumstances are unique, as is the process of preparing each loan application. With years of experience, FCTD has effectively helped borrowers with a diverse range of circumstances secure loans with both hard money and institutional lenders. Our strong track record and extensive lender network help us pinpoint the best funding for your project, even in the face of complex challenges.

As a premier provider of hard money financing, FCTD is dedicated to meeting the requirements of real estate investors and facilitating their success.

What Sets First Capital Funding Apart?

Why Do Investors Use Hard Money Loans?

Hard money loans offer a variety of benefits over traditional financing for those seeking to purchase, refinance or cash-out refinance. Key benefits include:

- Quick Closings: Hard money loans close faster, essential for those facing tight timelines such as a five-day offer deadline or an unexpected shortfall in bank financing. At FCTD, we’ve even closed loans within 24 hours in urgent cases. However, the standard timeframe typically ranges from 5 to 14 days.

- Credit Score Flexibility: Although hard money lenders will check your credit score for past payment history, it’s not a crucial factor for approval. Nevertheless, credit scores are still a part of the loan process. For instance, if you plan to refinance, a hard money lender will verify that you have a strong enough credit history to secure long-term bank financing when the construction or bridge loan ends. While minor credit blemishes are typically fine, a history of delinquencies and loan defaults could block your ability to get hard money financing.

- Financing for Non-Stabilized and Rehab Properties: Traditional bank financing is often inaccessible for properties in states of disrepair, vacancy, or high vacancy rates. In contrast, hard money bridge loans can help investors acquire these properties for renovation or stabilization, securing long-term tenants in the process.

For more reasons to use a private loan, read our blog post, Why Do People Use Hard Money Loans? 20 Examples.

What Types of Hard Money Loans Does FCTD Originate in Texas?

Texas hard money loans can be used for numerous investment and business purposes. FCTD originates the following loan types for Texas investors:

What are the Costs of a Texas Hard Money Loan?

In Texas, the costs and terms associated with hard money loans depend on various factors. Generally, origination fees hover around two to four points and interest rates range from 8.99% to 12.00%. Loan length can span from a brief three months up to 15 years for hard-to-finance properties such as cannabis facilities. Additional expenses may involve drafting and reviewing loan documents, which cost between $1,095 for a lender or broker and $3,500 for an attorney.

Unlike conventional mortgages, hard money loans don’t have a fixed pricing structure, but are determined by the specific borrower and property circumstances. These factors include:

- Loan Type: First Capital offers eight distinct hard money loan types and various bank programs.

- Property Type: Closing costs for a single-family home bridge loan are typically lower than for a construction loan for 10 speculative homes.

- Project Scope: A $30,000 cosmetic fix-and-flip project is simpler to finance than an 18-property, cross-collateralized blanket loan involving a mix of commercial and residential rental properties.

- Funding Source: FCTD collaborates with five different private money loan funding sources—individuals, real estate offices, family offices, conduit lenders and mortgage funds—each with their preferences for property types and scenarios to finance, which in turn affects the pricing structure.

- Availability of Capital: Complex projects with numerous variables attract fewer lenders, increasing the cost of funds. In contrast, straightforward, low-leverage financing scenarios (less than 50% LTV) offer a broader selection of funding sources.

- Borrower Track Record: First-time house flippers typically face larger down payments, higher closing costs and elevated interest rates compared to seasoned investors who have bought and sold multiple properties annually for an extended period.

- Borrower Liquidity: Borrowers with a solid financial history will enjoy a lower cost of funds than those with a history of debt defaults.

For more information on costs, read our Hard Money Loan Pricing, Interest Rates, Fees, Closing Costs blog post.