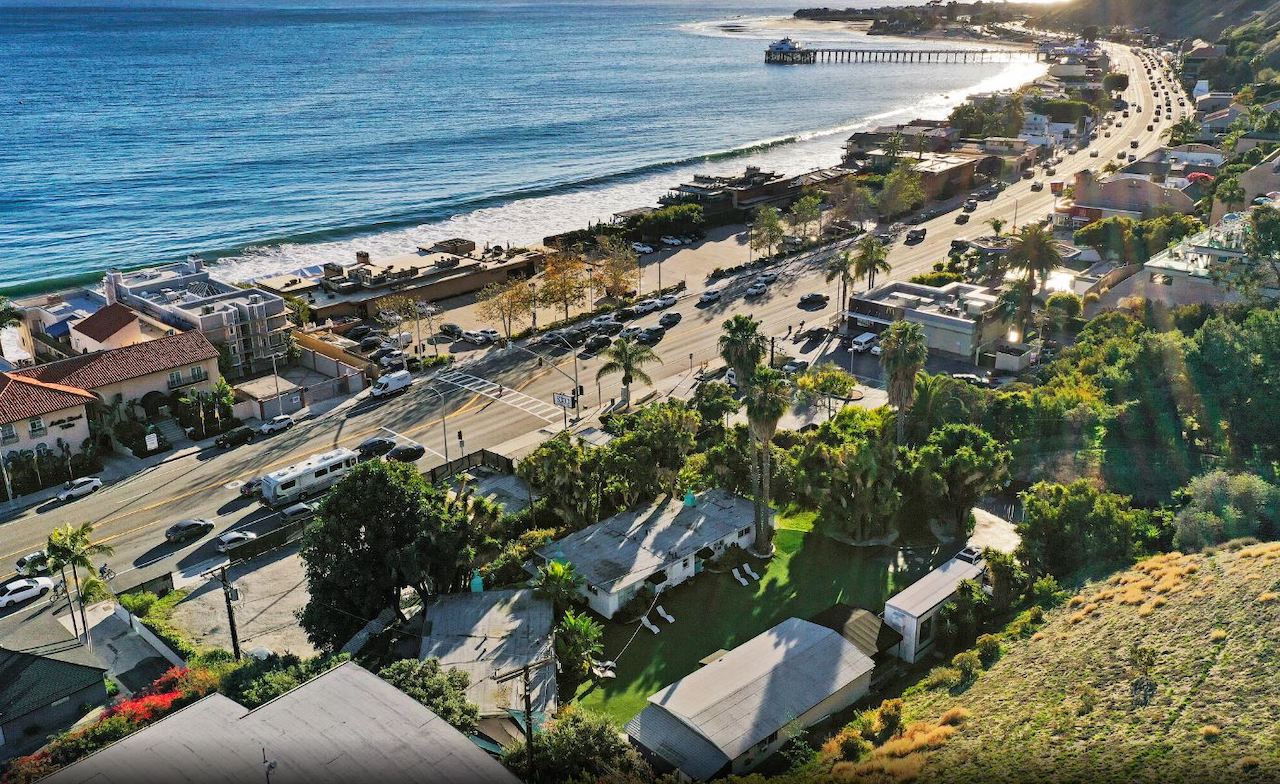

For real estate investors on the Westside of Los Angeles, hard money loans can play a pivotal role in your success. First Capital Trust Deeds (FCTD) is a hard money mortgage broker, securing private loans in Santa Monica, Malibu and Pacific Palisades since 2013.

What Sets First Capital Apart

Why is First Capital Funding considered a leading provider of hard money loans for Santa Barbara?

First Capital Trust Deeds is a hard money mortgage broker that originates a diverse range of lending options to fund your real estate investments. With access to multiple lending sources, we can help you secure the right financing for your specific investment requirements. Our team of experts have the knowledge and skill to guide you through the lending process, providing you with professional advice to help you make informed decisions. As a trusted source in the industry, we offer our clients the highest quality service and support to optimize their real estate investments.

Why Choose FCTD for Westside Los Angeles Hard Money Loans?

At FCTD, we’re seasoned experts in hard money lending. Simply put, we’re effective at placing loans, evidenced by the many repeat clients who trust us to deliver again and again. We’ve originated over 2,500 loans totaling more than $2.5 billion since 2013. In the previous year alone, we facilitated 500+ loans across 23 states, a testament to our wide-ranging industry knowledge and experience.

We understand that every client has special requirements, and we strive to meet them with specialized solutions. Whether it’s for a fix-and-flip, ground-up construction, second mortgage, or primary residence loan, we’re dedicated to finding financing that fits our clients' evolving requirements.

As a mortgage broker, we have the advantage of working with multiple capital sources. During the early stages of the COVID-19 pandemic, we adapted to the challenging market conditions by turning to mortgage funds, family offices, and individual trust deed investors. This resourcefulness allowed us to ensure our clients' projects continued moving forward, despite the uncertainty.

We recognize that our services aren’t for every borrower. However, we’re dedicated to helping our clients find the financing they need to achieve their objectives. We have the privilege of working with many clients long term, a testament to the trust and satisfaction they have in our services. If you're looking for a knowledgeable and friendly team to help fund your Westside Los Angeles real estate investment, we would be happy to serve you.

Exploring the Benefits of Hard Money Loans

When it comes to financing options, hard money loans can offer a range of advantages for those looking to purchase, refinance, or cash-out refinance. Here are some key benefits to consider:

- Faster Closing Time: Hard money loans can have expedited closing processes — a significant advantage for individuals who must meet strict deadlines. In urgent cases, some lenders can close loans in as little as 24 hours. However, the standard timeframe for closing is typically 5-14 days.

- More Flexible Credit Score Requirements: While hard money lenders will assess your credit score to evaluate your payment history, it's not usually the most critical factor in loan approval. However, it’s not irrelevant. If your aim is to refinance a construction or bridge loan, a hard money lender will want to ensure you have a strong credit score to qualify for long-term bank financing. Minor blemishes on your credit report are tolerable, but a history of delinquencies and loan defaults will likely prevent you from acquiring a hard money loan.

- Financing for Non-Stabilized and Rehab Properties: Properties that are in a state of disrepair, vacant, or have high vacancy rates are often ineligible for bank financing. However, hard money bridge loans can help investors purchase such properties for renovation or to stabilize with long-term tenants.

Overall, hard money loans can provide flexible financing solutions for real estate investors in many situations. It's essential to work with a reputable lender and carefully evaluate the loan terms to make the right decision for your needs.