First Capital Trust Deeds (FCTD) is one of the San Francisco Peninsula’s hard money loan providers of choice. FCTD works with real estate investors, providing short-term bridge, construction and investment financing for properties in Atherton, Belmont, Burlingame, Daly City, El Granada, Foster City, Hillsborough, Half Moon Bay, Los Altos, Menlo Park, Pacifica, Palo Alto, Portola Valley, Redwood City, San Bruno, San Carlos, San Mateo and Woodside.

Why is First Capital Trust Deeds considered a leading provider of hard money loans for real estate investors on the San Francisco Peninsula?

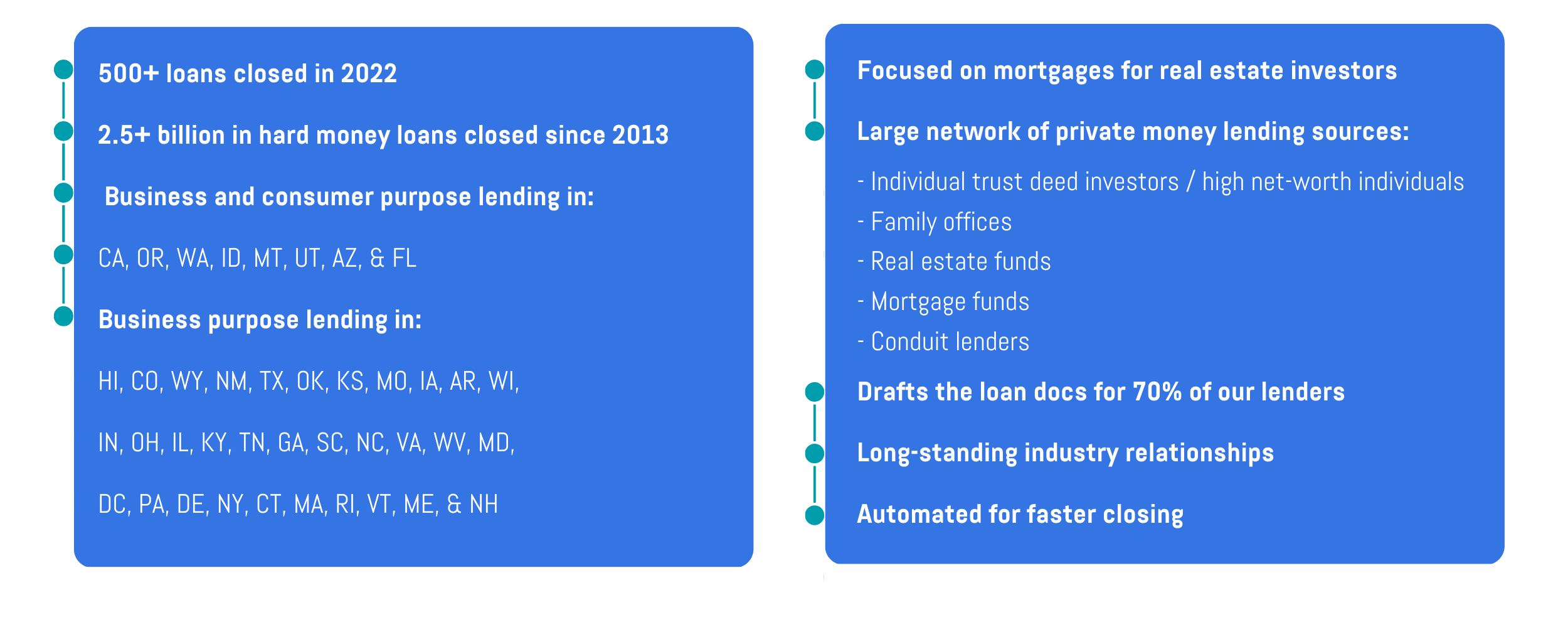

First Capital Trust Deeds is a hard money mortgage broker with numerous lending sources to finance your real estate investments.

What does this mean to you?

It means you can rely on one financing source to acquire, develop or renovate investment properties. First Capital Trust Deeds has you covered with a variety of long-term loan programs for stabilized investment properties.

We know firsthand that complex scenarios pose funding challenges for real estate investors. Every situation comes with its own set of obstacles. FCTD has worked with hundreds of investors to resolve challenges, find solutions and fund projects. We know how to navigate the setbacks that are part of securing loans, and how to leverage our expertise to your portfolio's advantage.

What Sets First Capital Apart

What Types of Hard Money Loans Does First Capital Trust Deeds Originate on the San Francisco Peninsula?

What Property Types Does First Capital Trust Deeds Lend Against?

What are the rates, fees, terms and other costs associated with a hard money loan on the San Francisco Peninsula?

Hard money loans in communities on the Peninsula often include origination costs of 2-4 points and interest rates of 8.99% to 12.00%. The loan's duration might be as short as three months all the way out to fifteen years, as is the case with hard-to-finance properties like cannabis facilities, which are underserved by institutional financing. Additional costs include drafting and reviewing loan documents, which can range from $1,095 for a lender or broker, or up to $3,500 for an attorney.

Hard money loans don't have a fixed price like conventional mortgages. Pricing factors in the specific circumstances of the borrower, property or special situation that need to be worked through to close on the loan.

- Loan Type:

First Capital originates eight different types of hard money loans and numerous bank programs. - Property Type:

A bridge loan on a single-family home will usually have lower closing costs than a construction loan to build 10 spec homes. - Project Scope:

A $30,000 cosmetic fix-and-flip project (carpet, paint and landscaping) is a much simpler loan than an 18-property, cross-collateralized blanket loan against a mix of commercial and residential rental properties. - Funding Source:

FCTD works with five different funding sources for private money loans – individuals, real estate offices, family offices, conduit lenders and mortgage funds. Each has preferences for the property types and scenarios they’ll finance. In turn, their pricing structure will reflect their risk level. - Capital Availability:

Fewer lenders will be interested in financing loans for complicated projects with lots of moving parts — which increases the cost of funds. But if your financing scenario is straightforward and lower leverage (<50% LTV), you’ll have numerous funding sources to choose from. - Borrower Experience Level:

A first-time house flipper will be required to have a larger down payment, pay more in closing costs, and shoulder a higher interest rate than an investor who has bought and sold 20-30 properties every year for the past decade. - Financial Strength of the Borrower:

Stronger borrowers will have a lower cost of funds than those who continually default on debt.

For more information on hard money loan pricing, please see our Hard Money Pricing Guide.